All the talk about job creation has become cheap, and in an election year we don't expect the posturing around "job creators" to stop anytime soon. Delivering results, not rhetoric, on matters of small business growth and job creation requires a new model based on equity to ensure that all residents co-create and prosper from that growth.

The quality of jobs, and the degree to which the people with marginalized socioeconomic status are able to participate in the growth and transformation of our economy, will affect our society for years to come. America cannot achieve the transformation it seeks without investing in people who have historically been excluded.

To build an economy that works for all, we must shed the scarcity mindset that plagues foundations, change our notion of investment "risk," and deploy larger amounts investment capital with fewer strings attached to ensure that enough resources are available to do whatever is necessary to succeed.

The more we invest in each other—especially the most vulnerable—the better off we all will be. By doing good, we will all prosper.

Scale is critical

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

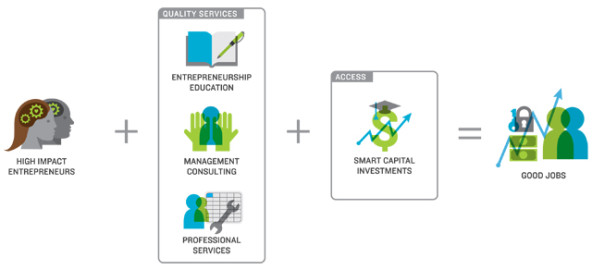

While there are many successful programs that help people become entrepreneurs, the challenge is to achieve greater scale—helping existing small businesses grow so that they can generate more jobs for the people who need them most. All entrepreneurs deserve the high-quality services and resource-rich networks necessary to bring their innovations to scale. In the effort to help more organizations achieve this growth, here are a few examples of how we at Inner City Advisors (ICA) go about doing this.

ICA is a local nonprofit with a nationally recognized business-accelerating model that provides entrepreneurship education, management consulting, quality advice, and investment capital to socially responsible entrepreneurs. With more than a decade of experience, ICA has created thousands of jobs by helping to scale local startups such as Revolution Foods, Blue Bottle Coffee, Back to the Roots, Prather Ranch Meat Co., and Premier Organics, among other socially responsible entrepreneurs.

ICA grows socially responsible businesses.

ICA grows socially responsible businesses.

ICA has leveraged its partnerships to increase the size and strength of our entrepreneurial support ecosystem, mobilizing government, private business, nonprofits, and the public to work in concert toward supporting entrepreneurs and creating good jobs. We are leading this charge by launching an innovative investment fund that enables local entrepreneurs to overcome their biggest barrier to scale, and to maximize the creation of good jobs and equity for all residents.

I’ve said before that ICA's model is a powerful case study for how to build an equitable economy that works for all people. Right now we need more resources invested into our model to dramatically increase its impact. There are too many underemployed people who can't afford incremental growth.

Leveraging smart capital investments to accelerate job creation

In direct response to the challenges our companies face in accessing smart, flexible capital, ICA secured seed investment from the Y&H Soda Foundation to structure an investment fund with two simple but far-reaching objectives:

- Capitalize on an overlooked opportunity by focusing on inner city companies as a new asset class.

- Create new jobs and wealth for inner city residents through the expansion of the businesses in which investments are made.

The rigor of this structure prioritizes our mission returns and will dramatically increase our social impact.

The ICA Fund invests in companies throughout the Bay Area to help these enterprises achieve equitable growth. In partnership with mission-aligned banks and investors, the ICA Fund offers debt products and alternative investment vehicles that support the growth objectives of ICA Portfolio Companies. Based on our analysis in 2011, the average debt financing need for ICA companies was $432,200. To the end, the ICA Fund's investments are expected to range in size from $100,000 to $500,000, filling a current void in the capital sector.

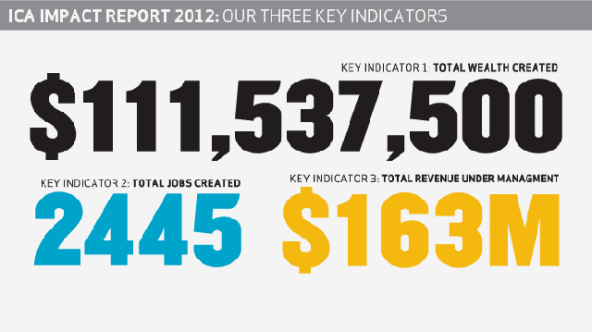

Good jobs, wages, and revenues are ICA’s three key indicators for success.

Good jobs, wages, and revenues are ICA’s three key indicators for success.

We know that there is a considerable opportunity to produce good financial and social returns by investing in local companies through a well-structured and well-executed investment strategy. The strategy is underscored by the implementation of ICA's full range of services—including high-caliber advising, financial forecasting, positioning companies for capital or liquidity events, and growth management—to maximize the return on investment.

The road to 25,000 Bay Area jobs

ICA is on a relentless mission to create 25,000 Bay Area jobs on an annual basis, and it requires an all-in investment from everyone in this region. At this point in time when job creation is so vital to our economy, a more intentional strategy is required to boost such classic measures of successful business outcomes, including: revenue, profit, market penetration, and product line development.

Our impact means nothing if it does not inspire investment from other stakeholders to act now and make bigger investments in our economic development model of quality job creation. Models that offer technical and financial resources (like ICA) are a critical link in the chain of service offerings that have a mission to build thriving communities. These models need more investments and philanthropic resources. Technical service providers act as the catalyst for positioning entrepreneurs for growth and scale.

We believe in the power of venture philanthropy (public and private) and partnering with organizations to provide the safety net that all stakeholders need to take the plunge into building thriving and economically diverse inner city communities. Together we can maximize the value to scale entrepreneurs and create an economy that works for all people.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Jose Corona.