A major challenge for social enterprises pursuing both a social mission and financial profit has been the absence of clear legal guidance about their responsibilities to investors and other stakeholders. In the United States, a number of new legal forms specific to social enterprise have emerged over the last decade to fill this gap. The two most common, the low-profit limited liability company (L3C) and the benefit corporation, modify traditional business legal structures to clearly enable and mandate the pursuit of social and environmental goals as a for-profit business enterprise. This is no small matter—the last major legal form to be created in the United States was the LLP in 1991.

The success of a new regulatory infrastructure for social enterprise depends heavily on the extent to which state legislators, then companies, adopt these forms. To date, a lack of good data has made it difficult to evaluate progress. To address this, we worked over the last year with Secretary of State offices and Intersector Partners to develop systematic, nation-wide data on adoption of these forms.

Adoption by states

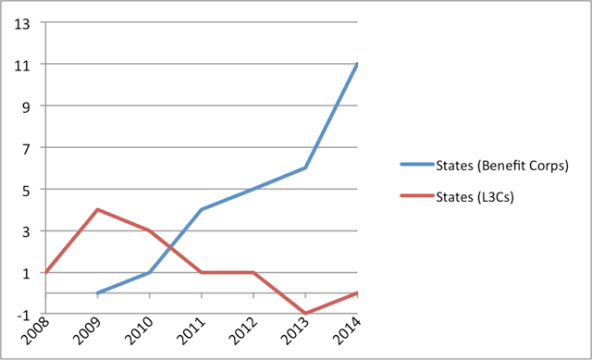

In 2008, Vermont became the first state to allow a company to register as an L3C, a form built on the LLC framework with the aim of giving for-profit, social mission-oriented companies the legitimacy necessary to attract certain types of philanthropic funds. The L3C form was passed by nine state legislatures, but legislation has slowed and even regressed slightly in recent years.

Passage of hybrid legal statutes in states by year.

Passage of hybrid legal statutes in states by year.

A second hybrid form built on the C-corporation framework, the benefit corporation, was first introduced in 2010 in Maryland and is now available in more than 20 states, including California, the largest state in the union, and Delaware, the bellwether of corporate law. While both oriented to supporting hybrid organizations, the benefit corporation and L3C were designed for different legal regimes and financing strategies.

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

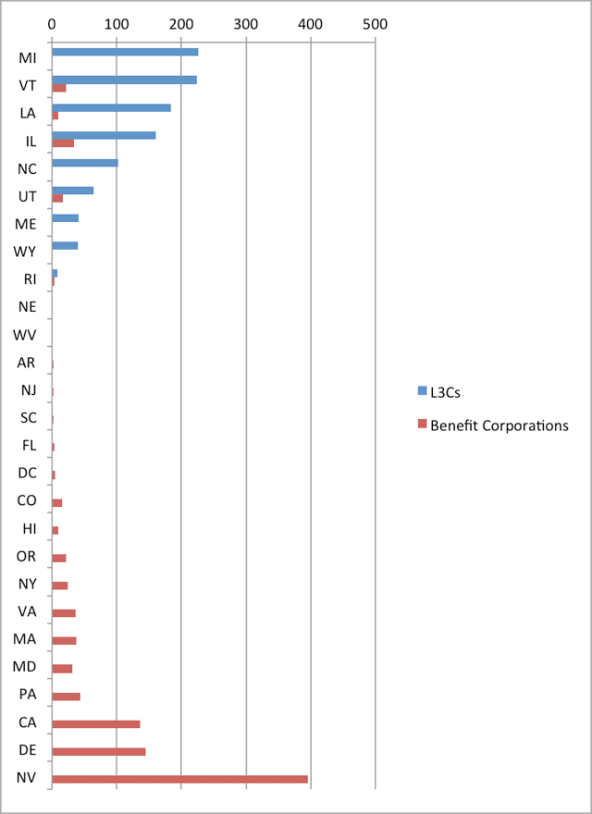

Interestingly, the states in which the L3C and benefit corporation are both allowed have little overlap. Only four states—Vermont, Illinois, Louisiana, and Rhode Island—have passed statutes for both forms.

Adoption by companies

Among the states that have adopted the necessary legislation, we turned to the question of adoption by companies.

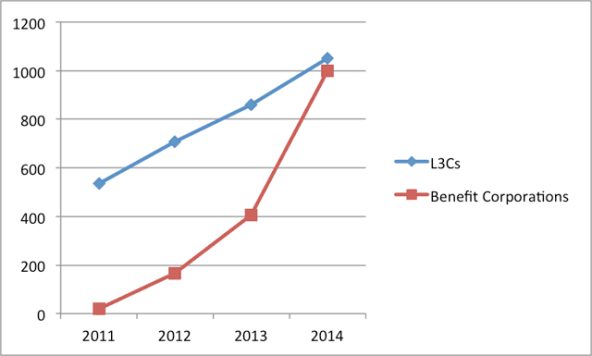

Number of L3Cs vs. benefit corporations over time. (Some dates estimated on the basis of available records and the date of data collection.)

Number of L3Cs vs. benefit corporations over time. (Some dates estimated on the basis of available records and the date of data collection.)

Aggregate numbers of L3Cs and benefit corporations by state and year.

Aggregate numbers of L3Cs and benefit corporations by state and year.

As of July 2014, we counted 998 benefit corporations in the United States from Secretaries of State (SOS) office lists and 1,051 L3Cs counted by InterSector Partners as of July 31, 2014. For purposes of comparing these two numbers, it is interesting to note that rates of LLC formation are typically much greater than C-corporation incorporation rates.

Patterns and opportunities

It is far too early to declare social enterprise legal forms a success or failure, but interesting patterns are emerging. Passage of L3C legislation seems to have stagnated, whereas benefit corporation legislation is quickly spreading across the country. Regarding which states pass benefit corporation laws, at least one study suggests a link to the presence of a larger green economy. However, at current rates, the benefit corporation form will soon be available in nearly all, if not all, states.

Adoption of these forms by social enterprises across states is more mixed. States like Delaware and Nevada are popular places for traditional businesses, which may explain dramatically higher benefit incorporation activity. Yet adoption is also shaped by more nuanced differences among states. The administrative burden of registering as a benefit corporation differs between states, and this is almost certainly responsible for some of the differences. For example, some of Nevada’s success may be traceable to the fact that it provides a simple check box on its standard corporation form to make adoption of benefit corporation status easier.

Many social enterprise advocates have proposed more-dramatic incentives linked to L3Cs and benefit corporations, such as special tax incentives, or other legal changes to make investing in social enterprises easier and more attractive. Such changes have yet to emerge except in very isolated and limited cases. This creates a chicken-and-egg scenario: Convincing regulators of the need for such changes depends in part on the existence of a significant population of registered social enterprises. But until such incentives exist, many social enterprises will continue to register under the more familiar for-profit or nonprofit forms.

The early growth of social enterprise legal forms offers an early glimpse into the challenges and opportunities of building the regulatory infrastructure for social enterprise. In the coming years, many regulators and entrepreneurs will make important choices about whether, and how, to use these forms. If these choices successfully clarify, legitimize, and reward the simultaneous pursuit of social goals and financial profit, they could have significant, lasting consequences for social enterprise in the United States.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Justin Koushyar, Haskell Murray, Matthew Lee & Kate Cooney.