Impact investing has evolved into a multi-billion dollar industry, with an estimated $10.6 billion dollars in capital invested in 2013 (top 125 impact investors), and projections of growth reaching hundreds of billions in assets under management within a decade (a 2010 J.P.Morgan and Rockefeller projection claimed that the sector could reach $1 trillion by 2020). However, recent surveys suggest serious barriers to scaling up institutional investments (as “financial-first” investments, the primary aim of institutional investment is to maximize financial benefits while achieving a predetermined level of impact), with the most commonly reported challenges among investors including: the shortage of good risk-adjusted investment deals, the lack of adequate investment track record, and limited exit options. Last year, a colleague and I from the International Institute for Sustainable Development (IISD) undertook a study of these major barriers and identified a set of systemic problems that are obstructing a wide-scale transformational trajectory. J.P.Morgan’s most recent impact industry survey suggests that these problems are not going away, and that focused and deliberate efforts on behalf of national and sub-national governments are the only likely saviours—a finding echoed by industry leaders, pioneers, and path breakers in the world’s oldest impact investment industry: India.

India’s Experience and Current Struggles with Scaling Up

India is has one of the most advanced impact investment sectors in the world. The challenges it faces in scaling up the impact sector reflect gaps in the global market and are relevant to all developing-country impact sectors.

In 2010, the president of India declared the start of the “decade of innovation” with a specific focus on addressing issues of poverty, and the scaling up of impact investing and social innovations. However, according to the government’s planning commission, only an estimated $80 million was invested in the impact sector in 2011, suggesting that there still exist many systemic barriers and scale-up challenges for enterprises and impact investors. Political and macroeconomic factors pose a constraint on the sector: According to the World Bank, India currently ranks 134 out of 183 in the ease of doing business, while other studies place India 74 out of 79 on entrepreneurship, and 62 out of 105 on innovation.

Faced with these challenges, the government established the National Innovation Council to develop and implement a “national roadmap for innovation” between 2010-2020, with the principle aim of building structures and policies that enable the government to organize, support, and scale promising enterprises. Since 2011, the program has involved an estimated 85,000 entreprises, leveraged 39 public-private partnerships, created 1 million jobs, and generated more than $4 billion in business revenue in poor communities.

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

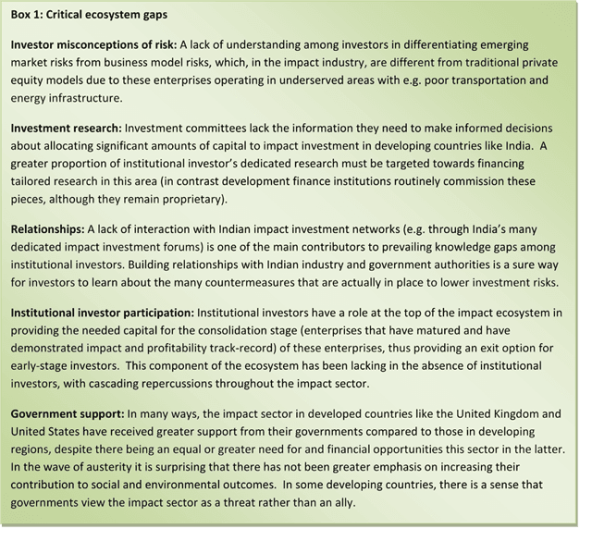

Despite these promising developments, industry pioneers (co-founders and C-suite executives at leading firms such as Aavishkar, IntelleGrow, and Intellecap) have expressed a lack of desirable progress in the impact investment pipeline. Despite their own earnest efforts to fill the gaps in the ecosystem (see our report), significant fault lines remain. Among these, the lack of institutional investor participation and government support were seen as most critical (see sidebar above). The absence of institutional investors has acted as both a symptom and cause of the restricted pipeline; In well-functioning ecosystems, the involvement of institutional investors completes the capital financing and enterprise growth cycle by offering exit options to early-stage investors when enterprises mature and demonstrate a sufficient track record, proof of business models, and scalability.

Toward National Impact Investment Readiness

Coming back to the need for government action in light of the persistence of scale-up barriers reported by investors, we at IISD encapsulate the single most important objective in a concept we call National Impact Investment Readiness. “Investment readiness” is a well-known concept in the investment field, and is traditionally defined as the capacity of an enterprise to understand and meet the specific needs and expectations of investors. At the national or regional level, investment readiness is about the size of the pipeline of investment-ready enterprises. It is a concerted effort to develop the capacities of enterprises by way of improving their internal processes (through closing readiness gaps and identifying ways to add value to these processes) and external opportunities (through building the impact ecosystem so that it is conducive to their growth). The Government of Ontario’s Northern Communities Investment Readiness Initiative is one example of a targeted effort to improve the size of this pipeline at a regional level, with social, environmental, and economic impact. We identified a preliminary set of five complementary conditions for such strategies to succeed, and the sectors responsible for fostering them:

- National political and economic context (government): The political and macroeconomic context of investments is one of the most important determinants of investment performance. These include “housekeeping” factors such as macro policies, political economy, local financial markets, corporate governance standards, and “plumbing” factors such as legal and regulatory frameworks, custody, clearing and settlement, and taxes.

- Impact investment policies (government): Policies that directly support the impact sector, and provide targeted financial, economic, technological, skills, information, infrastructure, institutions, and networks with the specific aim of developing internal capacities and external opportunities.

- Financial industry initiatives (impact investment industry): Initiatives by financial industry players (such as Avishkaar, Intellegrow, and Intellecap in India) to deepen capital markets, the availability of innovative financing, enhance competitiveness, and provide complementary resources and financing programs.

- Ecosystem completeness (government and impact investment industry): Impact investment players can interact synergistically due to the absence of critical gaps within the ecosystem, and in turn contribute to the size of the impact investment opportunity set, and the projected size and robustness of the investment pipeline into the future.

- Global fitness (government and impact investment industry): The need and expectations of international investors are met, including an entrepreneurial orientation of investees, their provision of adequate data and reporting, and quality relationships with global investor networks.

The power of this approach is that its usefulness extends to the institutional investors themselves; it provides a practical framework by which to evaluate emerging markets for impact investments. If adopted, governments can develop the impact investment ecosystem and promote the conditions necessary to unlock institutional investments, further improving the ability of the impact sector to contribute to social and environmental objectives.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Gabriel A. Huppé.