In their landmark article Cultivate Your Ecosystem, authors Paul Bloom and the late Gregory Dees highlight the interrelation of partners in creating social change, noting, “[S]ocial entrepreneurs must understand and often alter the social system that creates and sustains the problems in the first place. This social system includes all of the actors—the friends, foes, competitors, and even the innocent bystanders—party to the problem, as well as the larger environment—the laws, policies, social norms, demographic trends, and cultural institutions—within which the actors play.” As the company Target approaches its goal of investing $1 billion in education, it is putting a strong and growing emphasis on strategic investments in work that the social sector can scale and sustain. And like many investors, it is beginning to fully understand that scaling means understanding and respecting the complex interplay of partners that Bloom and Dees—and many others since—identified.

In 2013, Target invested $1 million in United Way Worldwide and the education nonprofit StriveTogether. Our goal was to test a model for achieving results at scale. We leveraged Target’s resources, StriveTogether’s results-driven methodology, and the United Way’s massive geographic footprint. We did this by convening a cohort of seven United Ways to function as collective impact “backbone” (partnership-coordinating) entities and equipping them with the StriveTogether methodology.

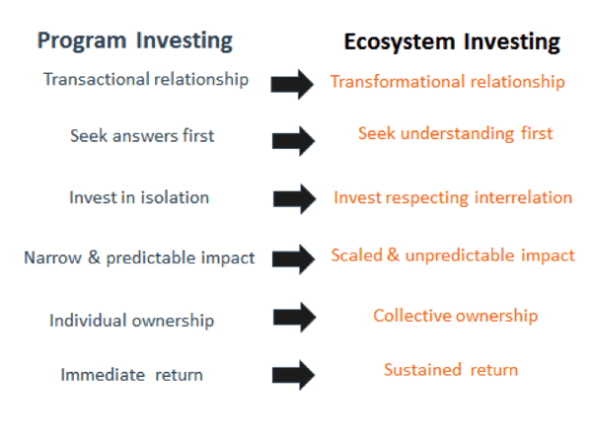

One critical insight we’ve gleaned from our work is that funders seeking impact at scale must view their work within the context of a broader ecosystem and adjust their behavior in response to change within that system. This insight builds on the framework Bloom and Dees provided, which describes players and environmental conditions in which an organization operates. We call this idea ecosystem investing, and it is inherently more complex, requires a different set of assumptions, and produces different results than traditional programmatic investing. The following differences emerged during our pilot.

-

Ecosystem investing requires funders to transition to a new set of behaviors and assumptions. (Image by Jeff Edmondson)

Ecosystem investing requires funders to transition to a new set of behaviors and assumptions. (Image by Jeff Edmondson)

Transactional vs. transformational: Program investments are typically linear, often hierarchical relationships between funders and nonprofits. The dynamic is similar to a client (funder) purchasing services from a provider (nonprofit). By contrast, ecosystem investors consider transforming the way they operate just as they may expect a practitioner to shift the way they are delivering services. As an example, we have seen United Ways that are shifting their grantmaking process from a focus on individual programs to networks of practitioners working on a common outcome. They are transforming the way they do business to achieve better results at scale.

-

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

Answers vs. understanding: Program investment is a bet placed on a known answer. For example, a funder may see a successful program in one community and import it into another. Ecosystem investors meanwhile identify a process to help understand the conditions for change. Many United Ways, for example, have invested in a process for engaging community members to identify and scale local practices that are having impact.

-

Isolation vs. interrelation: Program investing often involves an individual funder working with a single nonprofit to achieve a desired result, while ecosystem investing requires that investors understand and engage the complex interplay of partners and variables to move a specific outcome. Ecosystem investors work together with practitioners and other stakeholders to create conditions and solutions that achieve concrete outcomes. In our pilot, some United Way staff had to clarify in meetings that they were not there as a traditional funder but as a committed partner working to engage over the long-term to make improvements.

-

Narrow and predictable vs. scaled and unpredictable: Programs often attempt to address a very specific and definable problem with a narrow and targeted intervention. As programs improve, their results become more predictable for the specific population they target. Ecosystem investing, on the other hand, yields unpredictable results precisely because it operates within a dynamic environment. A proposed solution might result in an unexpected set of stakeholders engaging more deeply, and emerging as critical champions or challengers. For instance, one United Way focused on kindergarten readiness ended up supporting a group of Hispanic mothers who emerged as the best emissaries for training their peers in promising practices related to early literacy.

-

Individual vs. collective: Small groups of organized individuals with highly aligned objectives can drive programs. Ecosystems require a host of partners—each of which brings its own set of priorities—and are constantly re-establishing equilibrium and redefining roles. We saw United Ways model this behavior by engaging relevant community partners, and then making adjustments to their own approach and priorities to ensure advancement of collective goals.

-

Immediate vs. sustained: Programmatic investors often seek to deliver results in a direct and time-limited manner. Ecosystem investors push for the achievement of specific goals against a timeline, but recognize the need for and support infrastructure to sustain impact over the long-term. As an example, rather than jumping immediately into new activities, one United Way initially worked with partners on a data collection method that would help them form an authentic understanding of what would lead to improved outcomes.

In our pilot, all seven partners made significant, measureable progress building the civic infrastructure required to drive population-level outcomes for student achievement at scale. This success was the result of funders actively modeling the behaviors above. All of those engaged in this work will tell you it is a heavy lift and a long-term proposition. Our experience is that ecosystem investing holds incredible promise for addressing our most complex social challenges.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Kate Mohan, Jeff Edmondson & Stacey Stewart.