There is a clear trend happening that will, in some way, shape the future of corporations worldwide. They are starting to realize that they need to do good, to do right by society and the environment, and to accelerate their own corporate strategy. They are striving to create something that is enduring and positive for all stakeholders, not just shareholders. Companies are looking to define shared value, align it and measure it. Sound familiar?

In the past few years, there has been extensive research and observation of the companies and trends that exhibit this values-driven, “responsible operations” behavior. These companies exhibit this behavior while achieving greater financial success than their competitors. Michael Porter and Mark Kramer’s article “Creating Shared Value” and Umair Haque and Gary Hamel’s book The New Capitalist Manifesto are top of mind when we think about this trend, and there are many other influencers. These commentaries and initiatives often employ differing syntax, but they all boil down to applying a proactive approach—an approach that makes sure the company, through strategy and execution, is acting in a way that provides value to each stakeholder on that stakeholder’s own terms.

The authors above have documented the work of Walmart, Nestle, Google, Nike, Threadless, Tata, and other companies that are making comprehensive changes to all facets of their strategy and corporate culture to “do good” and “make more money.” What is important here, as Umair Haque argues convincingly, is that this shift is critical to the long-term survival of every company, not just the Fortune 1000.

The idea is deeply compelling, but “the how” and best practices are more difficult to propagate. Even today, for example, only 10 percent of companies have integrated customer experience with their core strategies. Similar ratios apply to the promotion of supply chain and partner optimization, employee engagement, and product design principles.

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

But there is a light on the horizon. A group in Toronto is working to establish an open source approach and model to articulate “the why” and “the how” for transitioning to a shared-value-based corporate strategy, and to provide guidance on driving this change profitably. This process delivers on the classic needs of defining corporate strategy while aligning the strategy with the customer, employee, supplier/partner, and society perspectives. It requires corporate planners to execute according to their normal process and also to establish a set of aligned objectives, from the CEO down to the front line, that consider each of the stakeholder communities—all while doing good to make more profit.

Defining Shared Value

The majority of people look at profitability with a different lens than they did 10 years ago. But how do you define what is good? And how do you measure and improve on “doing good”? To answer those questions, you need to ask enough other questions to truly understand the drivers of your own business.

Ask yourself who decides what is ultimately valuable. Shareholder value has really become “stakeholder” value as companies adopt the triple bottom line to deliver profit with purpose. Let’s assume stakeholders include shareholders, customers, employees, partners, and the communities in which your business operates (we’ll call this society). Focusing on just shareholders means that you are paying attention only to one small part of your company’s ecosystem and that you are missing out on other parts that can drive value and, ultimately, profit.

Assuming your company vision and mission are sound, you can start answering these basic questions by working with your stakeholder groups. Point being, you need to gain a full understanding of their needs and motivations:

- Shareholder: What drives your company and what drives those drivers? Examine relationships across the functional silos of your business, and how information is shared, from the C-suite to front-line management. How does information flow through your organization?

- Customer: Understand the complete experience, from customer awareness to customer advocacy. This means examining each step from a “motivational design” perspective and understanding the reasons why customers are drawn to use your product.

- Employee: Use the same process as you do for customers when you examine the employee experience.

- Partner: Look beyond your primary engagement with each supplier, distributor, regulator, etc. For example, in the case of suppliers, take a look at their suppliers, and make sure everyone is aligned with your company vision and mission. Then you can break apart your supply chain “from cradle to grave” and look for efficiencies.

- Society: Understand how your operations impact those outside your organization who do not necessarily buy your products and services, but who are still impacted by the operations of your organization.

Next, turn stakeholder needs into stakeholder value. That sounds simple, but it is a lot of work. We have found that the easiest way to define stakeholder value is to back up all the way to your business model. This means looking at customer segmentation, value proposition, activities, and everything else with all five stakeholder groups in mind. A good way to do this is to workshop your business model discussions using a broader set of lenses that includes all these groups. If you have problems building in shared value to your business model, it probably means you do not have a complete understanding of your stakeholders.

By refining your business model, and by rethinking your products and markets, you can redefine productivity in the value chain and maybe even help build supportive clusters. As a result, your revised business model and strategy will support strategic and social investments that drive value. But you still need to decide:

- How much you want to drive new revenue streams through social innovation

- How much attention you want to give to sustainability to reduce costs

- How you want to leverage philanthropy to drive goodwill/intangibles

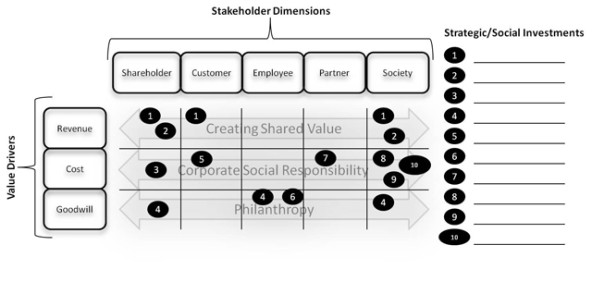

Figure 1

Figure 1

Here is where we may differ from the other camps: We do not see a progression or evolution from philanthropy to corporate social responsibility to shared value. We believe you need a mix of all three, since each serves a different purpose (see Figure 1). But regardless of how you think the pieces fit together, the approach should be similar. You should end up with a list of prioritized strategic and social investments and understand how they drive value for each group. From there, you need to implement these social and strategic investments in a way that you can measure and improve them.

Measuring Shared Value

So you need to be able to measure shared value to improve on it, but how? Once you understand your value drivers and come up with your strategic and social investments, you can start building a framework for measurement. Take the social investments Nestlé made with its Nespresso coffee and coffee-maker products:

- Philanthropy: The company contributes dollars and resources to the Rainforest Alliance to help benefit farmers, wildlife, ecosystems, and communities.

- CSR: The company modified its coffee sourcing and capsule recycling, and conceived energy-efficient machines to drive sustainability and lower costs.

- CSV: It re-architected its supply chain for Nespresso with the goal of driving real wealth for farmers and greater environmental performance, while creating the fastest-growing “billionaire brand” of the Nestlé Group.

In general, strategic frameworks show the link between stakeholder value and strategic objectives through business drivers (long-term) and business objectives (short-term), and between the metrics that are tracked to ensure the strategic objectives are met. It is important to understand that if your strategic objectives are supported by social investments, those investments will end up in your strategic plan and also become part of your company’s DNA. And if your social investments are aligned with company strategy and integrated into your strategic plan, you cannot eliminate them during economic downturns.

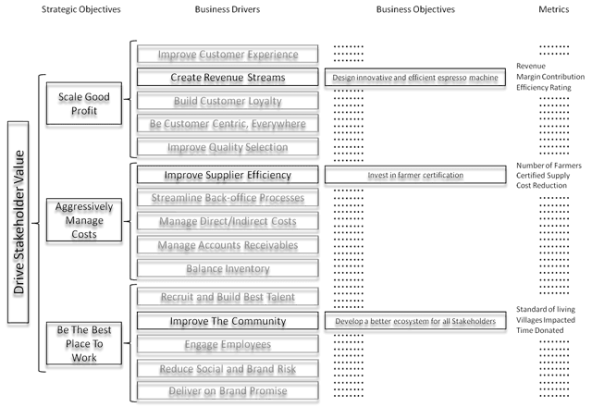

Figure 2

Figure 2

For Nestle, this simplistic diagram showing stakeholder value alignment (Figure 2) is meant to show strategic alignment. This is also part of a framework that shows how Nestlé might align its social investments with overall stakeholder value. The framework illustrates how a blend of social investments will drive revenue, reduce costs, and give back to the community while creating goodwill for Nestlé. Since the metrics in the Nestlé example are aligned with the business objectives, there is a clear line of site between the social investments made, the stakeholder value they provide, and the metrics used to drive performance.

To continuously improve stakeholder value, you need to align, plan, and report your social efforts. This closed-loop management cycle is important to ensuring that you drive performance across all stakeholder metrics (see Figure 3). Report and trend the stakeholder metrics regularly, and take time to analyze those metrics and the reasons behind your performance. The performance you observe should answer your original questions, if not you’re measuring the wrong metrics. We call this the “Moneyball of Creating Shared Value”.

Be proud of both your economic and social impact results. This is how you drive both profit and purpose, and how you measure the true worth of “doing good.”

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Rick Cadman & Derek Bildfell.