What’s sexier: Investing in ventures that offer game-changing ways to deliver better health or education to the world’s poor, or improving industry-wide distribution channels, customer awareness, and quality standards for such ventures?

OK, so that one’s a no brainer. Most of us would much rather play the part of the savvy impact investor than work to strengthen supply chains or enhance public goods.

Here’s a different question: Would you rather be a successful impact investor or someone who funds ventures only to find out that they aren’t achieving the sustained and scaled impact that you—and your capital providers—were expecting?

Another no-brainer, I guess, but this one is connected to the first question because I contend that you cannot be a successful impact investor—by which I mean one who’s making a lasting difference, at scale, against the world’s tough social challenges—if you don’t deeply understand the context in which your investees are operating.

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

This perspective comes from my own experience over the past 25 years as both an impact investor in a range of social ventures—such as rural solar power in Bangladesh and sanitation in the slums of Nairobi—and as a facilitator of sector-wide growth, including efficient lighting in South Africa and household water purification in India.

But beyond anecdotal experience, I’d like more in-depth analysis—and now we have it. It comes in the form of a terrific study just released by Monitor Deloitte (and more particularly, the Monitor Inclusive Markets team out of Mumbai, India) called “Beyond the Pioneer: Scaling New Industries to Benefit the Poor.” (Disclosure: I was one of several advisors who guided and reviewed this study over the last 15 months, so I am not a disinterested party. Still, I volunteered my time for this work because the social sector clearly needed it, and Monitor has delivered a readable, insightful, and actionable report.)

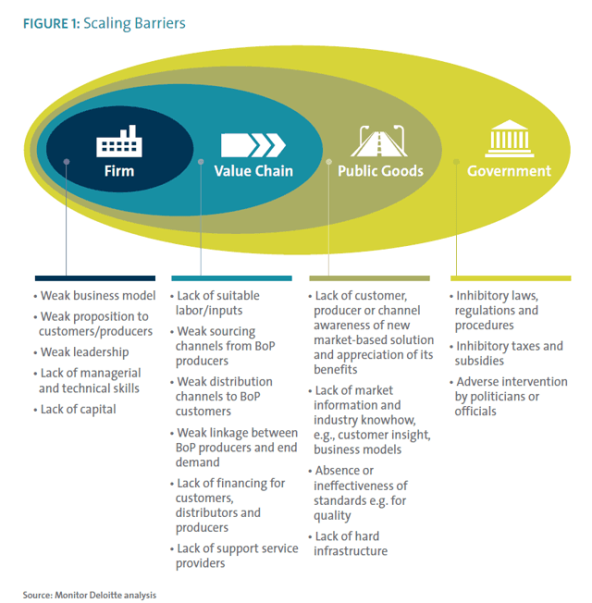

The most useful part of the report as I see it is the framework pictured below, which puts impact investments in their proper context: as one element in a market-based system for delivering better, more affordable, and more convenient goods and services to the poor. Better yet, this framework is a practical tool that can help a range of players—including social entrepreneurs, impact investors, development banks—do their jobs more effectively and efficiently.

Take an impact investor, who typically would focus on an individual venture and might not fully consider the broader market context in which that venture operates. The “Beyond the Pioneer” framework offers a guide for diagnosing the market system in which that venture will need to survive and hopefully thrive. Understanding the barriers in the value chain or missing public goods will increase the odds of the venture’s success by identifying areas that require extra attention or alternative approaches. It might also convince the impact investor that there are just too many obstacles outside of the entrepreneur’s control to warrant making an investment at that time.

Or consider an industry specialist in a government or development bank, who routinely takes a sector-wide perspective but might not always focus on market-based players and factors for their success. Applying the framework can identify high-leverage opportunities for encouraging social entrepreneurs, hence accelerating the rate of innovation in that industry and expanding the range of service providers.

The report offers much more than just this framework; it also includes lessons gleaned from reviewing almost 150 cases, of which 38 were subject to deeper research. Several case studies illustrate these lessons (my favorite is smallholder tea in Kenya, which has prospered where many others have failed, including smallholder coffee in Kenya and smallholder tea in Tanzania—a fascinating comparison). In all the cases, success at scale proved a long time in coming (think decades, not years) and involved a range of parties playing different roles and adapting over time.

So, if you’re looking for sexy, you’ll be disappointed. But if you want to increase the chances that market-based efforts will succeed at scale, take a dive into “Beyond the Pioneer.”

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Louis C. Boorstin.