In 2001, I left a lucrative executive post in technology to start the Taproot Foundation. I had always intended to return to the nonprofit sector, where I began my career, but it was hard to pull the trigger given the stability of my income and the exciting and innovative work I was doing at startups. In the end, I made the jump based on a simple realization: the present value of social investment.

At the time it was a fuzzier notion, but over the last 11 years it has become clear in the impact of our work on a daily basis. It is also something that I have come to express in a much more scientific way. It reminds me why I work in the nonprofit sector and why I try to never put off for tomorrow what I can get done today.

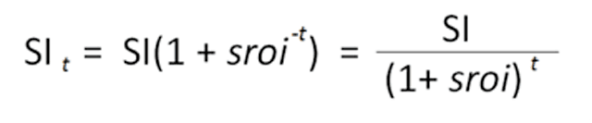

The present value of social investment (PVSI), or present discounted value, is the value given to a social investment made at a future date as opposed to today. The present value of social investment can be used to compare taking action today or delaying investment in addressing the nation’s social, environmental, or economic activities.

If offered a choice, a rational nonprofit executive (or administrator of a government program, citizen in need, etc.) will choose a donation of money, products, or services today over one made at a future time. They recognize that they can use it create greater value if it is at their disposal today and can use it to solve current challenges. PVSI helps a potential donor understand this relative value and helps nonprofits (and other recipients of social investment) articulate the rationale for up-front investment.

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

The best way to understand PVSI is to consider the concept of compounded social impact over a set period of time. Let’s say you are a Silicon Valley millionaire deciding if you should donate $1 million (SI) today or if you should wait until you retire in 20 years (t) to make the contribution. The group donation would enable a nonprofit to generate a social return on investment of 10 percent (sroi).

Like interest, social impact is compounding. For example, the later you invest in helping someone, the lower the odds of making an impact. An investment in a child younger than five years old can contribute to the development of a productive and healthy adulthood. If you were to make the same investment just ten years later, once they are in the criminal justice system for example, it would have a much smaller impact. This applies to how we invest in individuals, nonprofits, and government programs.

In the case of government, you can use this formula as a simple measure to weigh the cost of additional debt (interest rate) to increased current investment in both the economy and social programs (for example, teacher salaries). It goes beyond measuring tax income to look at the broader societal value of those investments.

As with the present value of money, the equation provides an input for decision-making, but it is not the only consideration. For example, it doesn’t factor in opportunity costs or risk. Also, because sroi is harder to calculate and predict than inflation or interest rates, this formula is best used for scenario analysis based on different sroi assumptions, as opposed to using it to arrive at a specific value.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Aaron Hurst.