Autodesk’s investment in the housing company Factory_OS includes both business and societal goals, including the measurement of embodied carbon, waste reduction, and worker prosperity. (Image courtesy of Autodesk)

Autodesk’s investment in the housing company Factory_OS includes both business and societal goals, including the measurement of embodied carbon, waste reduction, and worker prosperity. (Image courtesy of Autodesk)

In August 2019, 181 corporate executives of the Business Roundtable made headlines by redefining a corporation’s purpose, extending it beyond maximizing shareholder value to include a “fundamental commitment to all stakeholders” inclusive of employees, customers, and communities. Both criticism and applause followed the announcement. Then 2020 brought a global pandemic, rampant wildfires, a collective reckoning with systemic racism, and a corresponding economic crisis—events that disrupted business and society in unprecedented and interconnected ways. What it means for companies to commit to all stakeholders is being put to the test like never before.

While businesses have a lot more to do to fully embrace the ideals of the Business Roundtable’s ambitions, they are increasingly opting to invest capital for social impact as one way to “walk the talk.” Over the last 12 months, several companies have launched investment strategies to advance social-and-environmental causes alongside strategic and business goals. Much of this activity took place in early-stage innovation— venture investments with the potential to steer industries toward a more sustainable and equitable future—and has been led by a growing archetype of investor: the corporate impact investor.

A Growing Field of Corporate Impact Investors

Corporate impact investors make investments that are aligned with and amplified by their company’s strategic priorities, market position, and resources, in order to generate measurable, mutually reinforcing social and financial returns. Corporate impact investors use a blend of traditional tools, including corporate venture capital, corporate social responsibility, and corporate development, to intertwine business and societal goals through the investment process—until the success of one affirms and furthers the success of the other.

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

In other words, the investments target not only financial return and strategic value to a company, but also demonstrable positive social and environmental outcomes. While the relative priorities may change based on the entity, stage, team, and business alignment, most corporate impact investors operate under the premise that intentionality across all three pillars can yield reinforcing social and financial returns.

Patagonia was one of the first corporate impact investors in innovation, having set up a dedicated venture fund in 2013 to invest in startups “building renewable energy infrastructure, practicing regenerative organic agriculture, conserving water, diverting waste and creating sustainable materials.” Since then, more than 30 corporations have publicly launched impact investing strategies and funds, and even more are investing without any form of public announcement.

Of the estimated $715 billion total impact investing market, corporate impact investors in innovation now manage more than $7.2 billion in committed capital, an amount that has been increasing at a 54 percent compounded annual growth rate since 2016. In 2020 alone, Amazon, Microsoft, Salesforce, TELUS, Citi, and Unilever have each announced venture commitments exceeding $100 million.

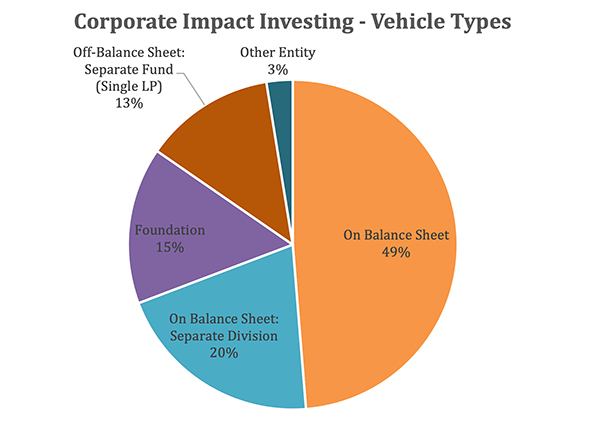

Corporate impact investing strategies often originate from the balance sheet, but companies are increasingly using alternative structures, including off-balance sheet funds, donor-advised funds, and fund of funds. Today, 70 percent of corporate impact strategies use the company’s balance sheet, 13 percent use an off-balance sheet fund structure, and 15 percent use a foundation or other philanthropic vehicle. The impact focus also varies, with 55 percent considering environmental sustainability a first-order impact target area, followed by social justice (35 percent), workforce development/education (23 percent), and health (10 percent). Of the strategies launched in 2020, 46 percent include specific diversity, equity, and inclusion targets.

Five Characteristics of Effective Corporate Impact Investors

While corporate impact investing is still a nascent field, with more validation points and definition likely to come in the years ahead, similarities among effective practices have begun to emerge. Based on market research and insights from our own investing practices, we share five characteristics of effective corporate impact funds that we hope will provide inspiration not only for what’s happening today, but also for what’s possible in the future.

1. Additionality

The concept of additionality involves using corporate resources, market position, customer networks, and supply-chain reach to add value to an investment beyond capital. A hallmark of corporate impact investing funds is leaning on the company to add value to the investment portfolio in meaningful and differentiated ways. The best programs have clear charters and internal networks of champions that can act quickly and meet entrepreneurs’ timelines. Increasingly, corporate impact funds are using their market position and supply-chain power to serve as a go-to-market partner, joint technology developer, or customer in valuable ways. In partnership, the portfolio and the company can achieve outcomes they wouldn’t be able to otherwise.

Amazon’s corporate development group, as a precursor to the company’s $2 billion Climate Pledge Fund, invested in a series B financing of Rivian, a Michigan-based electric vehicle manufacturer. Beyond providing equity to build the business and serving as a strategic business partner in the early stages of Rivian’s growth, Amazon committed to purchasing the first 100,000 Rivian trucks off the production line. This helped de-risk market demand for Rivian’s suppliers, employees, and other financiers, while providing early business and technology resources needed to allow the business to grow. While it remains to be seen whether Rivian can successfully electrify trucking and delivery, the company has now raised more than $8 billion at an estimated $27.6 billion valuation to make it a reality.

2. Collaboration

A start-up’s success depends not only on the business, but also on the diversity and strength of the overall ecosystem of accelerators, investors, advisors, and funders. Whether it’s nurturing the earliest ideas in an incubator or syndicating later-stage venture and private equity deals, a variety of individuals collaborate throughout a company’s life cycle. Corporate impact investors identify opportunities to add the specialized expertise, technology, and ecosystem value that a corporation often brings to both diligence and portfolio development. While corporate impact investors may not typically lead deals, they can be a helpful addition to a broader syndicate, and founders, ecosystem players, and institutional investors are increasingly seeking participation from corporate impact funds that offer differentiated value.

The Salesforce Ventures Impact Fund’s strong relationships with other investors, entrepreneur networks, and industry experts have been invaluable, generating high-quality deal flow, creating access to a broader set of founders, and informing investment theses and market maps. In 2020, Salesforce partnered with Endeavor, a global network of high-impact entrepreneurs, to gain exposure to founders outside the United States. The relationship ultimately led to an investment in Crehana, a Peru-based digital skilling platform, and the Salesforce Ventures Impact Fund’s first Latin America investment.

Collaboration is, of course, a two-way street; the Salesforce team has also opened doors inside and outside its own ecosystem for founders and others who would benefit from potential partnership and customer introductions, irrespective of an immediate investment opportunity. The company’s collaboration mantra, along with the early proof points of its first $50 million fund, laid the groundwork for launching its second $100 million impact fund in 2020.

3. Governance and Executive Buy-In

Executive buy-in from the C-suite and governance is critical to creating long-term stability and accountability. Corporate venture capital (investing along the two-axes of financial returns and strategic value) has historically expanded and retrenched during economic cycles, changes in management, and pivots in innovation management. To manage these challenges, successful corporate impact funds focus on garnering buy-in from the company’s most senior executives, establishing clear governance and investment-committee protocols with senior leaders for the impact investing program, and where feasible, incorporating investment mandates into the corporate charter itself. Done well, companies can preserve the long-term goals of impact investing through natural changes in economic and market conditions.

JPMorgan Chase launched its first impact investments in 2009 and was a founding partner of the Global Impact Investing Network (GIIN). As part of a $30 billion commitment to advance racial equity, the firm is deploying its own capital into early-stage companies through venture capital and lending to community development finance institutions. JPMorgan’s impact finance team is building an impact venture portfolio that includes investments in jobs and skills, financial health, neighborhood revitalization, and small-business expansion, with an emphasis on supporting entrepreneurs and communities of color. The impact finance team sits within the firm’s corporate responsibility unit and operates as a joint venture with involvement across the firm’s businesses. This embedded approach ensures that the program has broad organizational support, enabling the team to leverage the company’s expertise while maintaining impact fidelity and prudent investing standards. Direct and explicit buy-in from executive leadership further enables long-lasting organizational support.

4. Thesis Development

Effective corporate impact investing strategies and funds often use the company’s overall mid- to long-term strategy to inform the investment thesis. This typically includes identifying opportunities in alignment with the company’s mission statement and/or thematic focus areas, as well as establishing a complementary relationship between the impact investing portfolio and other strategic initiatives and corporate venturing vehicles within the company. This alignment informs clear evaluation criteria for new investments and portfolio performance tracking, and helps establish clear objectives for the relationship between social impact and financial returns. These criteria vary widely between companies, but consistency and clarity are common elements of successful practices.

As a global biopharmaceutical company, Merck’s growing impact investing portfolio demonstrates an alignment with the company’s commitment to health-care access and a more-sustainable global health ecosystem. Guided by an investment evaluation framework, an impact investing committee ensures that investments align with the company’s mission and complementary areas of activity. Specifically, the portfolio considers five complementary facets of global health: physical infrastructure, financial inclusion, digital and diagnostic solutions, pharmaceutical and vaccine R&D, and emergency response. Merck’s clear theses and evaluation criteria help the team determine when the company is the right investor, optimizing the portfolio and leading to the evaluation of more deals. As an investor in Leapfrog Investments Fund III, for example, Merck is supporting financial inclusion and health-care services for underserved consumers in high-growth emerging markets.

5. Impact Management

The intentionality to create positive social impact from investments naturally demands measurement, not only to validate performance, but also to inform investment and management decisions. As such, impact measurement and management is foundational to any successful corporate impact investing practice. The best practices integrate clear social and environmental objectives into the diligence process, deal structuring, and portfolio management throughout the life of the investment. This often involves collaborating with recognized practitioner groups like Impact Management Project and GIIN IRIS+.

Autodesk, a design and make software company, invested in the series A and series B financings of Factory_OS, a prefab multifamily housing-affordability company. In collaboration with Factory_OS leadership and the Autodesk Foundation, the company integrated impact covenants alongside the strategic deal terms of the investment—outlining success in terms of embodied carbon, waste reduction, and worker prosperity. To stay accountable to these goals, the management teams at Autodesk and Factory_OS formed a steering committee that meets regularly to collaborate on measurement initiatives and track progress against impact objectives alongside business and technology development goals. So far, Factory_OS has used the impact data and research to sharpen its story, hire talent, and bring on new mission-aligned investors.

Further Integrating Business and Society

The nearly $10 billion in corporate venture capital dedicated to social and environmental impact is just the tip of the iceberg. With more than $22 trillion of balance sheet cash and the ability to raise funds through financial instruments like green bonds, corporations have a unique and powerful role to play in accelerating the transition to a sustainable, inclusive, and equitable future.

Employees of firms big and small must ask their leadership, treasury teams, and corporate social responsibility programs how the company is investing its resources. Executives need to consider how the company’s balance sheet can do more for employees, customers, and the community. And those already deploying corporate capital should take the next step to incorporate mutually reinforcing mandates for financial returns, social impact, and strategic value. Collaborating and engaging with partners like the Global Impact Investing Network, Toniic, 500 Startups, TCFD, Mission Investors Exchange, Black Venture Institute, and Global Corporate Venturing are good starting points.

Together, corporations can move a step closer toward a commitment to all stakeholders, at a time when the need for business and society to work in harmony couldn't be more apparent. Thoughtful design and execution of corporate impact investing strategies can help future-proof businesses, activate purpose and inclusion, and spur sustainable innovation. By directing corporate capital with impact intentionality, we can spark a flywheel that reinforces positive social impact and long-term business value.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Ryan Macpherson, Claudine Emeott, Ken Gustavsen & Moses Choi.