OK, so maybe that title is a little hyperbolic, but “social-impact-focused businesses need to be sufficiently profitable to attract replicators” is a lot less fun. Besides, I like the idea that someone who makes life better for the poor might make as much money as someone with an app that delivers cat food to your door.

I didn’t always think this way. Mulago Foundation was about philanthropy, and it seemed kind of distasteful to get involved in business—if we did, we’d be “making money off the poor.” Even when it became clear that certain for-profit businesses could meet some of the basic needs of the very poor, I didn’t like the idea that someone might eventually make a bunch of money off our money.

And now I think it should be central to how we make investments in for-profit social ventures. Here’s why.

Impact at problem-solving levels of scale doesn’t come from one-off businesses. Impact at big scale requires that lots of businesses deliver a similar product or service over a broad geography—pay-as-you-go solar is a good example. That means pioneer businesses need imitators, and who’d want to imitate a business that barely breaks even? Pretty much nobody, and barely profitable businesses won’t scale. Somebody’s gotta get rich.

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

And therein lies a big problem. The need to be profitable (and keep investors happy) tends to drive businesses up-market, away from the poorest. In order to truly—and lastingly—benefit the poor, the impact and the target population need to be baked into the business model such that the model doesn’t work if it moves up-market. Here are a couple of examples what I mean by a baked-in relationship between target-specific impact and profit:

In Kenya, Komaza makes trees a viable cash crop for smallholder farmers on crappy land in semi-arid areas. Komaza specializes in efficient micro-forestry operations, and thousands of small farms serve as the business’s virtual plantation. Farmers get a big payment at harvest, with very little cost in terms of time or productive land. Komaza’s business model is completely dependent on the generation of substantial income for some of the poorest people in Africa.

In Rwanda, Inyenyeri gives people better cookstoves than they could ever afford for free, and then sells them the required fuel pellets at a cost lower than charcoal. (Only expensive stoves achieve low enough emissions to substantially improve health.) The more cookstoves Inyenyeri gives away, the more money it makes. Since the company has to keep the fuel cheap enough to compete with charcoal, there’s no reason to believe that it’ll drift away from the poor. Profit grows with impact and vice versa.

Of course, another necessary ingredient for scale is a big addressable market. Africa has an insatiable need for wood, and Komaza has a whole Sahel full of potential farmers. Inyenyeri has a zillion households burning charcoal. While a useful assessment of an addressable market requires a lot more than simply counting up the number of potential customers, there are plenty of big markets to tap, and the main thing social businesses need to do is to make sure they’re not stuck in a niche where scale can’t happen.

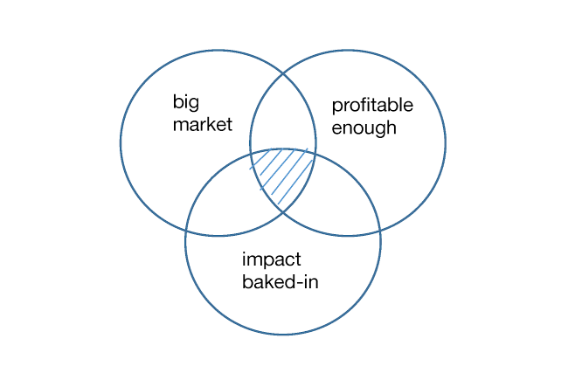

All of this brings us to the Mulago for-profit-impact-at-big-scale Venn diagram:

That shaded part—the sweet spot where scope, profitability, and (real) impact overlap—is where we aim our for-profit investments. It guides how we search and how we filter. It’s not like we don’t make mistakes; you take your best shot, but sometimes the impact doesn’t emerge, the market isn’t what you thought it was, or the business goes broke. The key is simply to understand that if you don’t have promising prospects for all three, you should keep your money in your pocket until you do. It’s a bar to get over, not a guarantee of success.

Clarity on this has made our life easier, but it’s also made our pipeline smaller. There just aren’t that many businesses that will meet a basic need of the very poor and land in the sweet spot. For now, that’s less of a constraint than you might think, because for all the hoopla, there aren’t very many investors putting debt or equity into early-stage for-profits that meet the needs of the poor: limited supply, meet limited demand.

The way to dial up both supply and demand is to make sure that sweet-spot ideas don’t get trapped in for-profit businesses that starve before they’re worthy of serious investment. We need to help entrepreneurs to use grant funding and nonprofit structures to develop, prove, and de-risk high-potential ideas until there’s proof of impact and a solid business model. Remember, philanthropy is about making good things happen that wouldn’t happen otherwise. In settings of deep poverty, the emergence of a high-impact business model that will scale could be one of those good things—even if, eventually, somebody gets rich.

In any case, if we’re serious about solving problems, marginal businesses won’t cut it. That has big implications for funders who reflexively urge organizations to structure as for-profits to achieve “sustainability.” In an effort to escape grant funding, these funders might transform a scalable nonprofit into a dead-end, one-off business. Dogmatic thinking about sustainability is limited at best, harmful at worst. “Sustainable” and “scalable” are not the same thing.

That Venn diagram has taught Mulago is that there isn’t much of a “fortune at the bottom of the pyramid”—at least not if you’re serious about impact—and impact investing as currently practiced may not have that much to offer the poorest of the poor. Sweet-spot business ideas—where a big market, attractive profits, meet baked-in impact—are precious. When we find them, let’s make sure the right money pours in the right way. In the meantime, let’s not fool ourselves about the rest.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Kevin Starr.