The Impact Investor: Lessons in Leadership and Strategy for Collaborative Capitalism

Cathy Clark, Jed Emerson, & Ben Thornley

384 pages, Jossey-Bass, 2014

How successful is impact investing? And how can more people be successful at it?

The Impact Investor works on the idea that we should measure performance not generically across all impact investments, but within segments based on the intentions of where the money comes from (the investor profile) and the investment strategy of where it’s going (the recipient profile). The book looks deeply at successful field practice; it is the result of two years of research into the detailed performance and practices of successful investors and fund intermediaries, which collectively manage more than $1.3 billion, deployed in over 80 countries. They selected 12 funds from an initial list of 350, on the basis of their investors’ documented satisfaction with both financial and social returns. The authors then looked across all the funds to discern patterns and lessons for the future.

The book emphasizes the multilingual nature of impact investing, in which successful transactions require translation, comfort, and understanding across public, private, and nonprofit sectors. In the following excerpt, the authors introduce their new segmentation of the impact investing space by describing four distinct types of fund actors: First Responders, Solution Specialists, Early-Stage Innovators, and Scale Agents.

The Impact Investing Fund Landscape

Our research on the twelve funds has delivered two important outputs. The first comprises the separate, highly textured stories of each of the funds in their own right—the most detailed public release of data on strategy, execution, and performance in impact investing to date. We will be delving deeply into the discrete experiences of the twelve investors throughout the remainder of the book. Full case studies are available on our project website. There is much to learn from their successes and the challenges they have overcome.

The second is the insights into the group as a whole: market-level data, such as the aggregated social impacts mentioned previously, and key characteristics and practices that were common across all funds. By selecting a “sample” of funds that is relatively representative of activity in the market to date, we are able to present a rough sketch of the field of impact investing as a whole and, as important, how it differs from traditional investing.

By examining the funds as a group, we were also able to synthesize the best practices we will be sharing throughout this book, and attempt to answer a critical question posited at the beginning of this chapter:

What, precisely, is impact investing?

We know that impact investing constitutes a diverse group of strategies, ranging from microfinance to community finance, markets for social enterprise, economically targeted investment, and international development. It is still too early to conclusively ring-fence a practice that is growing quickly and in a multitude of innovative directions.

Yet with access to data from the twelve funds, we have been able to ask and answer the foundational question of what purpose they each serve, bringing together disparate practices and painting a cohesive picture for the first time.

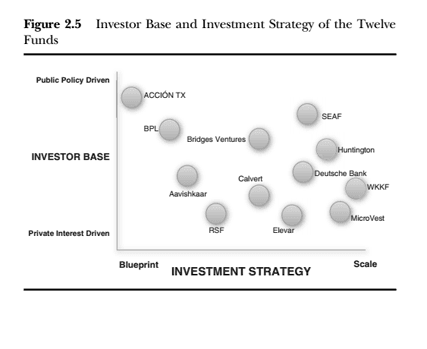

This analysis—or “market landscaping”—is anchored in two data points that best describe each of the funds. The first focuses on the capital flowing into the fund—that is, who and what kinds of institutions are investing in the fund, and why. The second focuses on the capital flowing out—that is, what type and scale of enterprises the fund is supporting.

We approach the first question by looking at the range of investors engaged in impact investing—government entities (including development finance institutions), investors motivated by public policy (for example, US banks fulfilling their CRA obligations), private foundations, commercial and fiduciary institutions broadly, and individuals—and then analyzing the particular mix present in each of the twelve funds.

Investors engage in impact investing for myriad reasons, informed by deeply held values and convictions, strategic institutional and mission priorities, rules and regulations, and, of course, risk-and-return objectives. However, our landscaping makes use of a single, particularly important distinction: whether investors are primarily motivated by “public policy” (the priorities and activities of government) or by “private interest” (operating without the influence of government). This distinction speaks directly to an important element of impact investing: Policy Symbiosis, which is one of our four key practices and the subject of chapter 4. We discovered that the specific mix of investors in any single fund provides clues as to the types of sectors they operate in and the extent to which these markets are characterized by failure and deep government involvement. We then categorized the funds as being supported by institutions that are predominantly motivated by either public policy or private interest—and all of the points on a continuum that connects the two.

We approach the second question—focused on where the fund invests—by examining the maturity of the enterprises receiving capital. All twelve funds have an explicit strategy of investing in companies at either an earlier, “blueprint,” stage, with its related strategic implications and challenges, or at a later growth, or “scale,” stage. This is specified in policy statements and partnership agreements. And with access to data on the size and nature of each of the fund’s actual deals, we were able to confirm that the reality matched the rhetoric. It should be noted that the funds we classify as investing at a later growth stage are still making much smaller investments in companies, at much earlier stages, than the typical mainstream investor in similar investment categories.

The “blueprint” and “scale” terminology builds on excellent research from the Monitor Institute that explored the particular challenges of early-stage impact investing.

The landscape takes shape when we place the funds on a simple chart, as shown in Figure 2.5. The vertical axis represents capital in—that is, the investor base of the funds, ranging from individuals and institutions that are entirely driven by public policy to investors driven entirely by private interest. The horizontal axis represents capital out—the investment strategy of the funds, ranging from “blueprint,” the earliest stages of a company’s development, to “scale,” the later stages of a company’s initial growth.

The chart allows us to readily compare the funds. MicroVest, for example, is worlds apart from ACCIÓN Texas Inc. (ATI); whereas MicroVest makes larger investments on behalf of primarily commercial, privately driven investors, ATI provides microloans to start-up businesses, supported by significant subsidies from the public and philanthropic sectors.

The analysis becomes more useful, however, when we generalize the landscape and create four quadrants of funds, each with its own unique set of characteristics, as Figure 2.6 illustrates.

Excerpted with permission of the publisher, Jossey-Bass, from The Impact Investor: Lessons in Leadership and Strategy for Collaborative Capitalism by Cathy Clark, Jed Emerson and Ben Thornley. Copyright (c) 2015 by John Wiley & Sons, Inc. All rights reserved. This book is available at all bookstores and online booksellers.