(Illustration by Aad Goudappel)

(Illustration by Aad Goudappel)

As government funding for social welfare services diminishes, considerable attention has been focused on a new funding approach—social impact bonds and pay-for-success contracts—that holds out the promise of attracting private investment capital to serve society’s critical social needs. Instead of government paying nonprofit organizations to deliver services like job training, private investors provide the funding and are repaid later by the government (along with a potential profit) if the service meets agreed-on performance benchmarks.

To understand how pay-for-success (PFS) and social impact bonds (SIBs) work, consider the example of recidivism. In 2014 the state of Massachusetts, the nonprofit Roca, the financial intermediary Third Sector Capital Partners, and a group of investors entered into a contract under which Roca was paid by investors to operate a program to keep formerly incarcerated young people from ending up back in jail. If Roca meets or exceeds the contract goals, the state will repay the investors their principal and potentially even a profit. (If the program fails, investors could lose some or all of their money because the government would not have to pay.) Massachusetts is willing to repay the loan with interest to investors because it saves even more money by keeping young people out of prison. Investors are willing to put their capital at risk because they believe that Roca’s program works, and because philanthropic funding is mitigating that risk. And Roca is eager to be a part of this complex scheme because it is a way to scale up its work with at-risk youths and young adults.

The idea of using private “return-seeking” capital to rescue at-risk youth, provide housing for the homeless, and educate pre-K children has wide appeal, with PFS proponents asserting that attracting private capital in the service of society may be the perfect innovation to plug the funding gaps in the government and nonprofit sectors. Some have suggested that directing even a small percentage of the $43 trillion of assets under management in the United States would unleash a huge flow of return-seeking capital in the service of public good.1, 2, 3

Although PFS and SIBs are generating attention, especially in the United States, after studying the initial contracts we believe that for now the model is appropriate only for a narrow cohort of nonprofits that meet two related criteria: they must be able to effectively deliver and measure their social impact; and they must be able to translate that impact into financial benefits or cost savings that are traceable to the budgets of one or more institutions or government departments. (The Massachusetts recidivism program is a good example of one that is well suited to this model.) The application of the PFS model for programs that fall outside of this set of criteria will be challenging and their success will require significant adaptations in financing and measurement.

This is not to minimize the potential social benefits of PFS programs: they will undoubtedly make an important contribution. By attempting to attract investments in the service of impact-driven models, government agencies will learn to quantify the costs of social issues and nonprofits will learn to quantify the benefit of their interventions, leading to a more effective partnership in serving society’s needs. Moreover, the more recent PFS programs, both in the United States and abroad, have targeted a broader array of social issues and attempted to craft innovative funding and measurement models.

Nevertheless, we believe that despite all the hype, PFS’s ability to attract pure return-seeking capital to social programs will be muted. If anything, given the prominent role philanthropy has played in recently launched PFS deals, PFS’s potential contribution will actually be to unlock philanthropic and foundation assets in buffering the risk for return-seeking capital or, in some cases, to entirely finance certain PFS projects. Ultimately, impact-seeking rather than return-seeking capital will spur the growth of PFS.

Although the potential social benefits of PFS appear to be real, one cannot ignore the likelihood of unintended negative consequences. A few high-performing nonprofit organizations thus far have received the bulk of the PFS funding, and rather than motivating the rest of the pack to “lift” their game and demonstrate effectiveness, the inability of these other organizations to raise PFS funding could hamper their ability to deliver social services. Moreover, we fear that after the initial round of savings have been effectively delivered in the first contract period, political pressure may force the lowering of the success payments for subsequent PFS contracts, in line with the new efficiency benchmarks. With little room for upside returns, we suspect private capital will be tempted to flee existing PFS markets. Most important, in the rush to quantify costs and benefits, we fear that there could be a retraction from those social issues where the outcomes are hard to pin down and successful interventions hard to identify, but which are the very issues demanding society’s attention and resources.4, 5, 6, 7, 8

Pay-for-Success in the United States

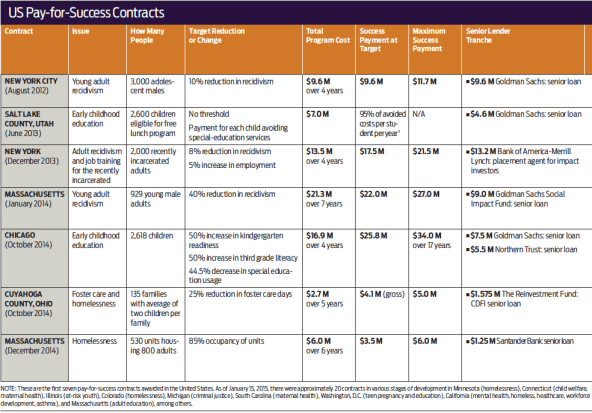

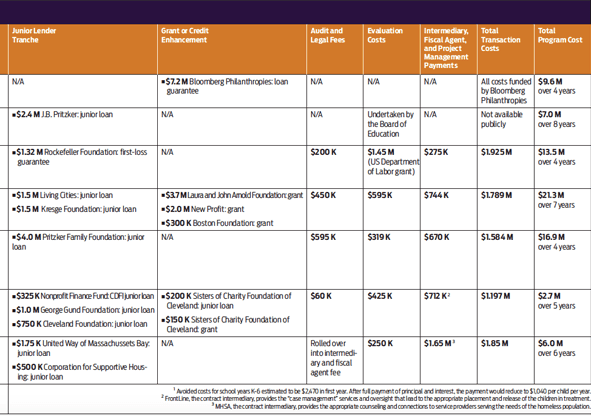

The first PFS contract in the United States was launched by New York City in 2012 to reduce juvenile recidivism, and six contracts have been launched since then. The first contracts addressing recidivism fell within the parameters of the type of programs that we believe can be successful—ones that are measurable and result in clear and significant cost savings. Subsequent contracts addressing other issues like K-12 education and homelessness have narrowed the scope of their service delivery and their target populations in order to fit the PFS parameters.

Many of the 20 or more PFS contracts that are now under development in the United States have stretched beyond the narrow domains of the initial PFS contracts. These new contracts that attempt to address social issues such as homelessness, mental health, and child welfare, across broad populations, may find it challenging to construct a robust PFS model correlating social impact and monetary savings. To attract private investment capital, they will have to devise new and innovative financing and measurement.9, 10

To better understand how PFS works, we will look closely at several of the contracts and examine how they promise to deliver social impact and generate aggregated cost savings.

Delivering social impact | PFS contracts in New York State, Massachusetts, and Cuyahoga County, Ohio, demonstrate the need to realize financial savings by delivering social impact.11 In December 2013, New York announced a PFS contract to improve employment and public safety. Historic data revealed that of the roughly 24,000 people released from prison in 2013, nearly 41 percent were likely to return to prison within five years to serve an average sentence of 460 days. The PFS contract engaged the Center for Employment Opportunities (CEO), which ran a successful employment re-entry program for former prisoners. CEO had demonstrated the effectiveness of its programs through rigorous and continuous program assessment and reporting.12, 13

An in-depth study by the nonprofit education and social policy research organization MDRC and the US Department of Health and Human Services estimated that CEO reduced return-to-prison rates by 9 to 12 percent through its job training and employment opportunity programs, saving taxpayers $20,440 annually per person, in addition to an imputed benefit of $10,585 per person on behalf of those who avoided being victims of crime. For every day a person stayed out of prison, the state’s savings plus society’s benefits were estimated to be $85. The PFS contract charged CEO with reducing recidivism through job training and placement by a minimum of 8 percent for 2,000 people, the level at which outcome payments would begin.

In January 2014, Massachusetts finalized a contract with the nonprofit service provider Roca to reduce young adult recidivism. Historic data revealed that of the nearly 800 young men released from prison in the state annually, nearly 65 percent would return to jail within five years of their release and serve an average sentence of 2.4 years. A significant proportion of the 3,000 young men on probation each year were also likely to violate their terms and enter prison. The estimated incremental cost of housing each prisoner is $12,500 annually (for food, uniforms, and prison programming), with a fully loaded cost (including housing, prison administration, and other overheads) of $47,500 annually, so the state would realize significant savings from reducing recidivism. That task was entrusted to Roca, a community-based nonprofit headquartered in Chelsea, Mass. Roca focuses on helping very high-risk young men stay out of prison, secure jobs, and stabilize their lives. Its intervention model is highly data driven, built on nearly seven years of evaluating and aligning its work with evidence-based practices and programs. Roca had demonstrated that its intervention was capable of reducing recidivism rates by 25 to 60 percent.14, 15

Similarly, in late October 2014, the Cuyahoga County government finalized a contract with FrontLine to reduce time spent in foster care for children of homeless mothers. FrontLine had devoted 26 years to providing comprehensive services to mentally ill homeless people, with the goal of transitioning its clients to permanent supportive housing. FrontLine had also demonstrated that moving homeless mothers to stable housing increased their chances of recovering and regaining custody of their children from foster care. The county’s data revealed that children of homeless mothers spent considerably more time in foster care than other children (724 days compared to 440 days) at a daily cost of $75 per child. Keeping mothers in stable housing with their children therefore represented significant savings for the county.16

CEO, Roca, and FrontLine are unusual. Unlike many social service nonprofits, they continuously assess their interventions, rigorously collecting data and tracking outcomes for each client. These attributes, along with the continuous adjustment of their service delivery models, make all three of these nonprofits ideally suited to the PFS model.

In Chicago and Salt Lake County, PFS projects are targeting early childhood education. Although the structure of these contracts, and the social issues they address, differ from those in New York, Massachusetts, and Ohio, all of these examples demonstrate targeted interventions for which an implementing organization has devised a highly structured and proven program. Independent studies of the Child-Parent Center, the service provider for the Chicago contract, reported that program recipients had a 29 percent higher graduation rate from high school, a 41 percent reduction in special-education enrollment, and significantly lower rates of juvenile arrest. Similarly, United Way, which oversees the Utah High Quality Preschool Education program in the Salt Lake contract, has reported that recipients are half as likely to need special-education services as children without preschool education.17, 18, 19

Aggregating cost savings | In order to fit the PFS framework and attract private capital, the service intervention needs to demonstrate not just impact but also aggregated cost savings that can be measured and traced to the budgets of clearly identified government departments. In New York State, a 10 percent reduction in recidivism by CEO is the break-even target, at which the federal, state, and local government savings will total $13.172 million, and be paid to investors. The state’s payments to investors are calculated according to prison savings, increased tax revenue from employment, and public benefits from lower crime. CEO’s success will be evaluated through a randomized control trial (RCT) to assess the number of reduced “bed days” in jail for the target population and the days of increased employment. With the performance payments capped at $21.544 million, public-sector savings and benefits will exceed the payouts by $8 million at a 30 percent recidivism reduction, and $16 million at a 40 percent reduction.

With the Massachusetts juvenile justice PFS, the state will achieve savings from reduced court costs and policing, as well as direct savings to the state Department of Corrections and the county Houses of Correction. The break-even rate for the Massachusetts PFS is a 40 percent recidivism reduction, the level at which the program savings and payouts will both equal $22 million. If Roca achieves a 70 percent reduction in recidivism, the payout will be capped at $27 million and the state will save an additional $18 million over the contract period. At that level of impact, Roca will receive additional payments up to $1 million, Goldman Sachs will be paid up to an additional $1 million, and the Kresge Foundation and Living Cities will each receive up to an additional $300,000.

In Cuyahoga County, while numerous government agencies will likely realize savings from keeping children with their parents and out of the foster care system, the PFS contract specifically benefits the Department of Children and Family Services. If FrontLine reduces by 25 percent the number of days that children of homeless mothers spend in foster care, the Cuyahoga County government will return investors the entire savings in the form of success payments of $4 million, plus a nominal interest payment. At a 50 percent reduction, success payments will be capped at $5.5 million with the county saving an additional $3.5 million. Although the Cuyahoga County contract addresses a very different social issue from the Massachusetts and New York state projects, the RCT evaluation model and framework for tying government payments to those outcome measurements (and associated government savings) are virtually analogous.20, 21

For social challenges that cannot easily identify and aggregate societal benefits and correlate them to cost savings, the PFS model’s effectiveness is more difficult to demonstrate and has to be structured differently. The Chicago and Salt Lake County pre-K education programs base the cost savings on each child who avoids the need for special-education services as a result of the intervention ($9,100 a year for Chicago and $2,470 a year for Salt Lake County). The Chicago contract’s payout structure also rewards the benefits delivered, paying $2,900 for each student who is “kindergarten ready” after attending the program. Both programs lack rigorous RCTs to assess success and correlate social welfare interventions to Department of Education savings, instead relying on standardized testing to measure educational achievement and special-education placement. Chicago chose to use a quasi-experimental comparison group of children who did not attend a preschool program and Salt Lake County relied solely on evidence-based secondary research documenting the positive effects of a preschool program. It is little wonder that, given the tenuous correlation between government savings and education intervention, the Chicago and Salt Lake contracts have come under criticism regarding the trigger points for paying back private capital.22

Unintended Consequences

While the PFS model’s focus on impact measurement is an important step in improving program effectiveness, it also poses a challenge for many nonprofits, few of which are as well equipped as Roca, FrontLine, or CEO to rigorously measure impact. After all, evaluating any nonprofit’s impact is both expensive and necessarily complex, ranging from its outputs (How many high-risk young men stayed out of jail?), to broader outcomes (Are those same young men placed in stable jobs and are they better off financially?), to long-term social impacts (Is the result greater economic and social equality?). Correlating those impact measures to monetary returns is even more difficult, and many social interventions simply defy the kind of impact measurement and linkage to financial savings the PFS structure demands. Such measurement will likely prove difficult for nonprofits already struggling to fund services, let alone finance the human and technical resources to support sophisticated measurement and tracking systems.23

The Massachusetts contract to address homelessness illustrates why the focus on linking impact measurement to cost savings poses challenges for social issues where that alignment is difficult. The state has a homeless population of nearly 16,000, with Boston alone having on any given night 7,000 people living in shelters, hospitals, and emergency medical facilities, or on the street. The contract’s Home and Healthy for Good model, created by the Massachusetts Housing Shelter Alliance, provides housing first, choosing to address issues of medical and mental health and substance addiction, after the move. To demonstrate rigorous cost savings, the PFS was focused on a narrow segment of 800 chronically homeless people, leaving open the question of how society could address the needs of the remaining thousands of homeless people.

NOTE: These are the first seven pay-for-success contracts awarded in the United States. As of January 15, 2015, there were approximately 20 contracts in various stages of development in Minnesota (homelessness), Connecticut (child welfare,

maternal health

NOTE: These are the first seven pay-for-success contracts awarded in the United States. As of January 15, 2015, there were approximately 20 contracts in various stages of development in Minnesota (homelessness), Connecticut (child welfare,

maternal health

1 Avoided costs for school years K-6 estimated to be $2,470 in first year. After full payment of principal and interest, the payment would reduce to $1,040 per child per year.

2 FrontLine, the contract intermediary, provides the “case management” serv

1 Avoided costs for school years K-6 estimated to be $2,470 in first year. After full payment of principal and interest, the payment would reduce to $1,040 per child per year.

2 FrontLine, the contract intermediary, provides the “case management” serv

Given the PFS model’s focus on measurable societal impact translating to financial savings, and the need to provide financial returns to private-sector investors, the “best in class” and most well established nonprofit organizations will likely get the bulk of PFS funding. In Massachusetts, two nonprofits, Roca and Youth Options Unlimited, were originally selected by the state to bid on providing services for the recidivism contract. By the time the PFS contract was finalized, however, Roca had secured the entire agreement and the resulting funding. Although the premise of the PFS model is to motivate whole segments of nonprofits to “up their game,” it is also possible that the “also-rans,” like Youth Options, could be further handicapped in funding their operations, resulting in even poorer social service delivery to populations that need them most.

In New York City, the government’s contract with the Osborne Association to assist recently incarcerated young adults effectively shut off government funding for similar nonprofits, including the Center for Community Alternatives, increasing the pressure on these organizations to focus on fundraising rather than on creating sophisticated measurement systems and better programs. PFS projects in Chicago and Salt Lake City were awarded to education providers holding existing government contracts, without an open bidding process. This creates little incentive for other providers to innovate and operate more effectively in the hope of landing a contract.24, 25

In a perverse twist, the very success of the initial PFS projects may make it more difficult to do follow-on projects. After contracted nonprofits deliver the first round of government savings, political pressure will inevitably demand ratcheting down the success payments for subsequent contracts in line with the recently achieved efficiency benchmarks. Given the higher target and thus higher chances of falling short, private capital may flee existing PFS markets, and potential service providers may find it impossible to deliver critical services at ever-higher efficiency without compromising the well-being of the people they serve. Conversely, the model’s initial success may undermine the very premise of PFS and encourage governments to eliminate the PFS intermediary (and associated costs), and contract directly with providers. For example, in the United Kingdom the Peterborough Prison project was on track to achieve the target recidivism reduction of 7.5 percent over two cohorts, but failed to reach the average 10 percent reduction target for the first cohort to trigger initial payments. Subsequently, the UK government announced an early phase-out of the project and began constructing interventions building on lessons from the Peterborough program using its own direct funding without the need for intermediaries or investors.26

Another challenge is the seemingly high transaction cost of the initial PFS contracts, much of which has been funded by philanthropic contributions. In some cases the transaction costs can be as high as 7 to 10 percent (Chicago and New York State), but many of these costs, such as auditing and legal fees, would have been incurred regardless of the form of contracting. The one clearly additional cost, evaluation, is at the heart of the PFS structure and does not exceed 2 percent of the project costs in any case. The most contentious of the transaction costs is “intermediary and fiscal agent services,” with some arguing that the additional management oversight is superfluous.

The Role of Philanthropic Funding

Although PFS contracts are typically characterized as employing private capital-market funding to solve social problems, a closer look at all of the US PFS projects reveals the critical and enabling role of philanthropic and mission-led capital. (See “US Pay-for-Success Contracts” above.) To better understand the role of such capital in the PFS funding structure we have divided funders into three categories: senior lenders, junior lenders, and venture philanthropists.

Consider the first US PFS, the New York City Rikers Island contract. In that deal, Goldman Sachs, the senior lender, provided a $9.6 million loan to fund the four-year program to reduce recidivism, with Bloomberg Philanthropies granting MDRC a $7.2 million loan guarantee to hold until 2016. A little more than two-thirds of Goldman Sach’s investment was protected by philanthropy.

The senior lenders in the Massachusetts PFS have shown more appetite for risk, but $6 million of the $18 million initial commitment is still philanthropic. Goldman Sachs represents the profit-seeking senior lender, while the Kresge Foundation and Living Cities represent the junior lenders carrying a higher share of the risk. Goldman Sachs, which is financing $9 million through its Social Impact Fund, will be the first investor to receive its capital if Roca meets its targets, plus a potential bonus. The Kresge Foundation and Living Cities, which are providing program-related investment (PRI) loans, will be the second-in-line investors to be paid back, along with a potential upside. The role of these junior lenders cannot be minimized. The primary motivations for their investments are the project’s alignment with their mission and its potential for impact. Philanthropic investors will be the last to see their principal repaid. The Laura and John Arnold Foundation will use any returns it receives to support future PFS initiatives, while New Profit and The Boston Foundation will reinvest their returns back into Roca to scale up its work.27, 28, 29

The New York State contract is unique because of the private-placement nature of the investment, where 44 entities (individuals as well as foundations) have bought into an asset class with Bank of America-Merrill Lynch. The Rockefeller Foundation provided a first-loss guarantee to cushion the risk for the investors. While the bulk of the financing has come from impact investors, philanthropic funders are absorbing the initial risk, as in the Massachusetts deal.

In Cuyahoga County the contract is being financed entirely by philanthropic dollars. The majority of the funding, $1.575 million, comes from The Reinvestment Fund, a community development financial institution (CDFI), another $325,000 of the junior lending from Nonprofit Finance Fund is also a CDFI loan, and the remaining $2.1 million is spread among the George Gund Foundation, the Cleveland Foundation, and the Sisters of Charity Foundation of Cleveland. The project is effectively the first instance of a PFS financing without private investment capital, where the funders are overwhelmingly focused on social impact rather than financial returns. The Massachusetts Home and Healthy for Good PFS contracts are also heavily funded by mission-driven investors. The Chicago and Salt Lake County PFS contracts are unusual in being totally funded by return-seeking first-level lenders.30

Even the United Kingdom’s so-called Social Impact Bond, launched in 2010 and widely considered the first large-scale implementation of social innovation financing, was funded largely by philanthropy. In a public-private-nonprofit partnership, the UK Ministry of Justice contracted with One Service to reduce recidivism among prisoners released from Peterborough Prison and engaged Social Finance to raise £5 million to finance the up-front program delivery costs. The vast majority of the 17 “investors” were charitable trusts and foundations, with the payback coming from the UK Big Lottery Fund and the Ministry of Justice. Hailed as a groundbreaking financial innovation to solve social problems, the UK SIB was the first in a series of deals in which philanthropic and private capital joined forces to fund socially innovative approaches to society’s critical challenges, with philanthropists in most cases buffering the risk for private investors.31

When one looks at the seven initial US PFS contracts it is clear that of the three investment levels, only the first layer is structured to attract potential market-return-seeking investors. Much of the project risk is absorbed by the second and third layers, whose interests and motivations differ from those of the profit-seeking investors. At best, these funders may receive their principal with a lower than market return or, in the case of philanthropic investors, their principal depreciated by the amount of lost interest, to recycle into another social investment. That is not the case for the profit-seeking PFS investors, who have the first claim to the promised rewards. Without the risk reduction provided by impact investors and philanthropists, we believe that market capital will not rush to fund PFS deals.32, 33

The Future of Pay-for-Success

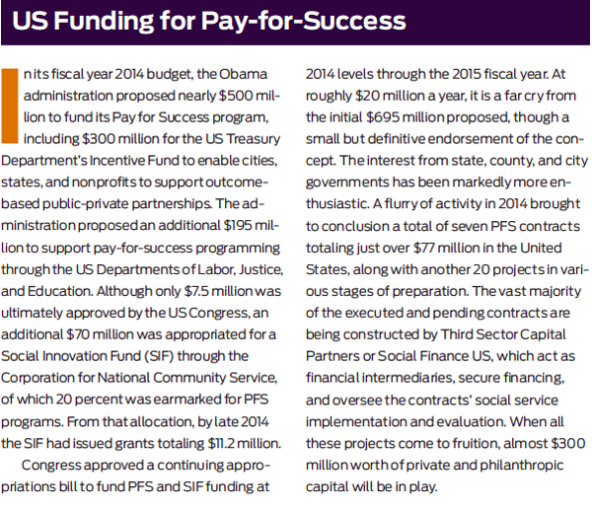

All of the new PFS contracts being negotiated from Connecticut to California will require service providers to demonstrate rigorous data collection and impact reporting. These projects targeting juvenile and adult incarceration, homelessness, health care access, education, and other social challenges not only will raise the bar for nonprofits to demonstrate robust indicators of their outcomes but also, we believe, will fundamentally change the way governments procure and deliver social services. (See “US Funding for Pay-for-Success” below.)

By using PFS contracts, and importantly philanthropic dollars, to construct a new impact-driven model for meeting social needs, governments and nonprofits will learn to operate more effectively. PFS is an important step toward making governments and nonprofits accountable and more effective in serving society’s neediest citizens, and to the extent that PFS employs private capital to serve this end, the money is well spent. The motivations of social impact investors in PFS projects, and investors’ prioritization of social impact over financial returns, could make the critical difference in how the sector develops. Market capital will have a role to play, but return-seeking investors will participate when the financing structure minimizes their risk, as recent contracts have done. 34, 35

Globally, active PFS contracts total roughly $200 million. The United Kingdom is the epicenter of PFS and SIB activity, with almost £55 million committed to 15 projects focusing on recidivism, youth employment, and foster care avoidance. The European Commission has expanded its Social Business Initiative to foster social entrepreneurship and investments in social innovation throughout Europe, where PFS projects to address adult and youth unemployment have been launched in the Netherlands, Germany, and Belgium.

Farther afield, Australia (where the model is known as a social benefit bond, or SBB) and South Korea have embraced the model to target foster care, family support, and child welfare issues. Some of these are characterized by innovative financing structures. For example, in New South Wales, Australia, the service provider (The Benevolent Society) has combined with two leading banks to offer a three-tiered capital structure for a $10 million (Australian) SBB. In the first level, the investor’s capital is fully protected and a low interest is paid over the life of the bond regardless of the program’s performance, very much like a conventional bond. Such an innovation in the financial structure could open the doors for pension funds and other institutional investors seeking to diversify their investment portfolios.

Similarly, in Rajasthan, India, Children’s Investment Fund Foundation will pay out the initial $238,000 in funding for a development impact bond, financed by UBS Optimus Foundation, to deliver education programs to 10,000 underserved Indian girls through the nonprofit Educate Girls. Philanthropy stepped in to fill a void where a cash-strapped government did not have the budgetary savings to backfill private investors (in this case, impact investors).

The pivotal role of philanthropy in these projects mirrors the evolution of PFS that we see in the United States. The contract in process in Santa Clara County, Calif., is the most recent indication of this approach, where the government’s anticipated launch of a PFS project to address homelessness is a direct indication of its commitment to care for its neediest citizens. Although financing for this contract has not been finalized, the prioritization of social welfare above cost savings suggests a mature evolution of PFS contracting with philanthropy and impact-seeking investments gaining center stage.36, 37, 38, 39

The early termination of the New York City, Rikers Island, PFS in July 2015, after failing to meet its recidivism goals, and Goldman Sachs resulting $1.2 million loss in outcome payments, illustrate why return-seeking investors are unlikely to invest in PFS projects without the cushion of philanthropic risk absorption. Bloomberg Philanthropies is taking the biggest loss, after all, paying out $6 million to Goldman Sachs’ without receiving any success payments from the city. It also provides valuable lessons for governments about how to vet service providers for PFS contracting. Similar to the Peterborough project, the New York City government too will hopefully apply the lessons learned from its PFS “experiment” to structure its own recidivism programs.

Considering the fundamental role philanthropic and mission-led investors are playing in PFS and SIB projects around the globe, the future of PFS lies in aligning with impact-seeking investors, not return-seeking investors. Despite early projections for PFS and SIB instruments to enlist private capital to solve social ills, we are encouraged by its potential to stimulate more foundation investments in the sector, potentially sidelining profit-seeking investors. US foundations, with assets of nearly $700 billion and average annual grantmaking of $40 billion in the past 10 years, have long been criticized for their relatively low levels of program-related investments, only about $500 million a year on average. Among the country’s largest private foundations, impact-related investing constitutes only about 2 percent of endowment spending and roughly one-half of 1 percent of grant spending. The emergence of foundations as leading players in recently launched contracts is indeed encouraging, and we see this—not the engagement of private market capital—as the potential major funding source for the PFS model. This development, along with improved efficiency and effectiveness of both government and nonprofit social welfare provisioning, will be the real and measurable benefit of the PFS model for society’s neediest citizens.40, 41

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by V. Kasturi Rangan & Lisa A. Chase.