In our previous article, we argued that the impact investing sector should focus more on what is required to spark, nurture, and scale entire sectors for social change. Though investing in firms is an essential component to driving sector-level change, it is ultimately sector development that matters the most. As Alvaro Rodriguez of the impact investing fund Ignia has written, “Single firms are born, they mature, they get lazy and they die. But industries prosper over time and reach scale as competition fosters the delivery of better products at lower cost.”

We also described Omidyar Network’s evolution toward greater willingness to experiment with all the tools necessary to drive sector-level change. One of the things that ON has realized is that we invest differently when we consider a firm’s sector impact. If we do NOT consider sector-level impact, we are likely to under-invest in organizations—particularly early-stage, high-risk innovative firms—that have the potential to create a new industry sector or fundamentally transform industry sector dynamics.

Three key insights emerged from our exploration of this topic:

1. Social impact needs to be measured at the SECTOR as well as the firm level

The impacting investing community has made significant strides at developing tools for assessing the social impact of individual firms. Efforts such as GIIRS and IRIS give impact investors a taxonomy to benchmark how firm-level outputs contribute to social change. For example, if you’re a health care provider, we could record the number of patients treated and what the outcomes were and then compare those results to others in the field.

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

Absent from these measurements, however, are the positive externalities your firm may create for the sector as a whole. For example, your company may be the first entrant in a market where regulatory structures are weak, management talent scarce, and customers are highly suspicious of the efficacy and safety of your offering. While you may not be able to reach of millions of people on your own, your own trial-and-error efforts may develop a new model that lowers the risk and makes possible the entry of later health care providers that in turn can touch tens of millions of lives.

In essence, we are arguing that:

This insight stems from the work of pioneering impact investors, such as the Ignia fund, which has recognized that some firms in its portfolio are facing both sector and business risk and that each type of risk creates different challenges and necessitates a different investment approach and set of expectations.

2. Three Categories of Actors

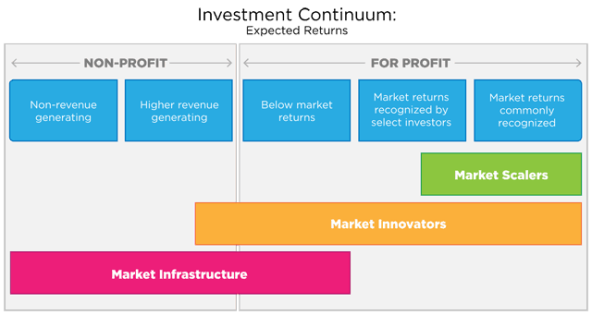

Our analysis suggests that firms/organizations can be broken into at least three distinct categories according to their impact in growing an industry sector. It’s important to note that the generalizations below are derived from our experiences serving markets with disadvantaged or poorer customers; they do not always apply to higher income market segments. We would also emphasize that this typology is meant to apply to the development of for-profit markets for social impact, not necessarily for social impact sectors that are covered primarily through grant-making.

Market Innovators

These are the trailblazing entrepreneurs and teams that believe in a product or service well before its profit potential is obvious to most established investors. They contribute meaningfully to advancing a sector by de-risking the generic model of an innovation or product. Some sector innovators, though not all, will also be able to scale up on their own as individual firms.

Example: Bridge International Academies is pioneering low-cost, high quality education for poor schoolchildren in Kenya, using a “school in a box”’ model that standardizes innovations in service delivery for easy replication. Because this was the first of its kind, and sector risk was high, many of Bridge’s early investors were motivated more by philanthropic intent and did not expect market rates of return. After several years, Bridge has managed to de-risk the model considerably, scaling to 82 schools—--significantly increasing its own valuation and attracting more mainstream investors. More importantly, Bridge has now defined a model that can be replicated by others. Indeed, this may be Bridge’s biggest contribution, just as Grameen and BRAC’s biggest contribution to microfinance was the model itself.

Returns expectations: Market innovators exist across the returns continuum—from revenue-generating nonprofits, such as microfinance pioneers in the 1970s, to firms such as Bridge Academies International, which has the chance to generate market rates of returns. In general, however, market innovators are the “high beta” investments of the impact investing world; returns are highly uncertain. In our view, this is where there is the biggest need for socially motivated impact investors to take appropriate risks and to invest in the human as well as financial capital required to help ambitious entrepreneurs refine and scale up their world-changing ideas. A long-term view is also essential, as innovators can take many years to become commercially viable. Monitor research, for example, suggests that most businesses serving millions of poor customers in India took at least 15 years to reach scale.

Open issues: We need better ways to measure and predict meaningful contributions to de-risking a sector, so as to ensure disciplined investing. Extreme caution is also necessary to minimize the likelihood that a subsidy might inadvertently distort and slow market development. Finally, we would note that there is a shortage of impact investors who are willing to dedicate the considerable time, energy, and cost required to nurture early-stage, high-risk market innovators. More on all these issues later in the series.

Market Scalers

Market scalers enter a sector after a generic model has been de-risked. They accelerate the growth of a sector by scaling as individual firms. They may also tend to refine and enhance the generic model.

Example: Grameen Bank took 15 years to reach its first million customers with its pioneering model of microfinance, while Indian microfinance firm Equitas (which entered the market in 2007, nearly 30 years after Grameen) scaled from zero to one million plus customers (and from one to 40 million dollars in revenue), in less than five years. The most successful market scalers are able to expand rapidly by tapping commercial capital markets; in the process, they are able to extend access to needed goods and services to millions in need.

Returns expectations: Market scalers are more likely than market innovators to achieve risk-adjusted market rates of return. Indeed, it is critical that many market scalers DO earn risk-adjusted returns, as this is the most viable means of raising enough capital to scale up to serve millions. It is important to note that given the high-risk environment in which many market scalers operate, they may sometimes still be perceived by mainstream investors as too risky. Impact investors with local and/or deep sector knowledge are more likely to understand the returns potential.

Open issues: If financially successful, market scalers (and indeed highly profitable market innovators as well) are likely to raise concerns about mission drift and “appropriate” levels of profitability—as evident in the intense debate on the role of commercial microfinance. Successful enterprises serving disadvantaged populations also face tricky political issues, as their very success may threaten entrenched economic interests or raise concerns among politicians who view themselves as advocates for the poor and may be uncomfortable with private sector approaches to social problems. More on this, too, in a later article.

Market Infrastructure

Industry players often have common needs that are most economically served in collective form. Infrastructure players advance a sector by addressing these collective needs, thus helping to build a supportive ecosystem for entrepreneurial innovation.

Example: Many different categories of infrastructure exist, from industry associations (e.g., GSMA’s Development Fund, which works to increase access to mobile financial services to the poor, among other goals) to information exchanges (e.g., the MIX, which provides financial data and social performance metrics for microfinance).

Financial returns expectations: Often, though not always, market infrastructure organizations can find ways to derive revenue from the services they provide, and sometimes even can cross the threshold toward profitability; however, they are rarely hugely profitable.

Open issues: Market infrastructure organizations should strike the right balance in pursuing revenue streams for sustainability and growth. While charging for services allows organizations to test their value proposition, not all forms of industry leadership can be easily monetized, especially in the earliest stages of a sector. If they are to be sustained, therefore, these infrastructure organizations need to be able to demonstrate their value—either to paying members or grant-making organizations. We would also note that LACK of infrastructure can disrupt an otherwise burgeoning sector, and that many times the infrastructure needs to be developed at a national level. The lack of a credit bureau serving Indian microfinance institutions (MFIs), for example, contributed to the over-indebtedness problem that was a significant contributor to the microfinance crisis in the state of Andhra Pradesh.

3. Investments in all of these different vehicles and returns profiles are necessary to move a sector

It’s commonly known, for example, that most early MFIs started out as grant-funded NGOs. After early-stage innovators demonstrated the generic model to be commercially viable in the late 1990s, sector growth was driven largely by scalers, many of whom were able to tap commercial capital markets. These for-profit firms (many of which converted from not-for-profits), brought financial services to additional tens of millions of previously excluded people. All along the way, infrastructure organizations such as the Consultative Group to Assist the Poor (CGAP) and the MIX played a key role in enabling this scale.

Omidyar Network contributed to the growth of microfinance by investing more than $100 million across 28 organizations, 15 not-for-profits, and 13 for-profits. Roughly two thirds of our funding went to organizations helping to provide financial services for the unbanked; the other third went to infrastructure groups, such as MFX (a currency hedging facility for MFIs) and the IFC’s global credit bureau program.

A sector-level view is relevant far beyond microfinance. We see strong potential for other sectors to accelerate as well—from low-cost education for the poor in emerging economies (being pioneered by Bridge Academies, among others), to mobile payments platforms (such as those enabled by M-PESA). We believe that to scale up, such sectors need to ultimately produce the “win-win” (high social return, high financial return) investments that will enable them to tap the commercial capital markets.

But before we can tap capital markets to enable sector lift off, it will take high-risk tolerance, hard work, and persistence to identify, fund, and support the best market innovators and infrastructure organizations required to kickstart the process of sector development. More on this in the next article.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Matt Bannick & Paula Goldman.