If you took a college Ethics course, you may remember the famous debate between philosophers Immanuel Kant and John Stuart Mill. To simplify, Kant proposed that intentions determine whether an action is right or wrong. Mill, generations later, claimed that outcomes, such as how many lives an action saves, determine morality regardless of motives.

There were echoes of this 200-year-old debate during a recent gathering of the 100% IMPACT Network, a sub-group of the impact investing network Toniic, consisting of family offices, foundations, and individuals who have committed 100 percent of their assets to positive impact. The 100% Network promotes the industry consensus that true impact investing requires both intention and outcomes—or in more spiritual terms, both heart and mind. Intentions align moral values with money management strategy, while outcomes measure the financial, social, and environmental impact of investment decisions. A recent G8 Taskforce report agreed, stating (emphasis added): “Social Impact Investments are those that intentionally target specific social objectives along with a financial return and measure the achievement of both.”

How does this work? If an investor cares about poverty, she funds a business that provides affordable health services to low-income communities. As the business increases its profits and number of customers, it satisfies both Kant and Mill (and the investor’s financial advisor).

Yet in reality, the vast majority of investments seeking impact fail to achieve both intent and outcomes, leaving the 100% Network and others scratching their heads over how to achieve their goals. Why?

Diversified Funds: Missing From the Impact Investing Party

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

Impact investors, like general investors, hold the vast majority of their assets in diversified funds. Funds own dozens or hundreds of publicly traded equity or debt positions, weighted toward Fortune 500 companies, to generate financial returns and volatility that track benchmark indices as prescribed by modern portfolio theory.

Funds make it easy to translate values into action. With the click of an online trade, investors can replace traditional funds with new impact funds that own more “good” businesses—with higher environmental, social justice, or gender performance—and avoid “bad” ones.

This has created a massive market. The “Global Sustainable Investment Review 2014” estimates that sustainable investments constitute roughly 30 percent of global professionally managed assets—more than $21 trillion. Sustainable investments include socially responsible investment funds (which exclude sectors such as tobacco or weapons), as well as more ambitious funds with strategies that incorporate environment social governance (ESG) data, build thematic portfolios (such as affordable housing), and promote shareholder action.

Therefore it may be confusing to read a recent GIIN/JP Morgan report, which states that the impact investing sector is only $60 billion in size—350 times smaller than sustainable investing. How can this be?

Aside from some exceptions in microfinance and affordable housing, diversified funds have limited ability to demonstrate measurable outcomes. Trillions of dollars of sustainable investments have not stopped weapons and tobacco companies from rapidly growing, and selling stock in Anheuser-Busch and Phillip Morris to buy Apple and P&G doesn’t measurably change outcomes the next day. The high bar to becoming an impact investment has forced most assets into funds that actually may not be improving the world.

Some banks and asset managers claim they can achieve outcomes through diversified funds. The most accepted theory holds that impact investors, acting together, can shift the market cost of capital. Good companies can then access cheaper capital to accelerate growth, while bad companies face prohibitively expensive capital.

But four structural factors inhibit impact funds from changing the cost of capital. First, they diversify among many large companies, resulting in weak leverage on any one. Second, bad companies often generate large cash flows to fuel their own growth, limiting investor influence. Third, selling company stock puts downward pressure on its valuation; this incentivizes profit-driven investors to increase their holdings to arbitrage the mispriced asset, rebalancing the cost of capital. Finally, impact is in the eye of the beholder, as many investors realize after learning that many impact funds own large positions in Coca-Cola or PepsiCo. Any company will fit the values of a subset of impact investors—for example, local communities often laud coal companies for job creation and affordable energy despite the loud protests of environmentalists.

To summarize, diversified funds fulfill an intrinsic purpose by aligning asset holders with their values, but we need a better framework for generating measurable outcomes.

Direct Investments: Seeking Mainstream Capital for Scale

Direct investments consist of individual companies—often small and growing—or vehicles with less than a dozen assets, including venture capital, private equity or debt, and many alternative assets. Instead of tracking indices, direct investments assess the value, growth potential, and risk of each asset independently.

Every sector has examples of high-growth direct investments delivering impactful products and services at scale. Do you care about health? Revolution Foods delivers more than a million healthy meals to schoolkids each week. Sustainability? RecycleBank’s rewards program increases recycled material by 700 million pounds annually. Education? EverFi has provided education on topics such as alcohol awareness and financial literacy to more than 7 million students. Examples like these build excitement about impact investing’s potential.

But to scale, these companies have also relied on funding from mainstream, profit-driven investors. In fact, for every impact investing success, there are 10 examples of biotech, edtech, and cleantech companies funded wholly by mainstream investors generating similar health, education, and environmental outcomes. Mainstream capital plays its strongest role in sectors dominated by market forces, such as technology innovation, while philanthropic capital becomes more important in sectors subject to market failures, such as poverty alleviation.

It is easy to assume that mainstream investors invest in traditional companies while impact investors fund only social enterprises, but the biggest direct investment success stories are in traditional companies with a mix of mainstream and impact investors.

One area where traditional companies play an unrecognized role is job creation. Huntington Capital recently reported that its two impact funds made $87 million of direct debt investments to create 548 new jobs and to support more than 2,600 jobs in underserved communities. That is great news. But a large company like Costco alone has more than 170,000 employees, 88 percent with health benefits. If it creates jobs more cost effectively, would funding Costco to hire 10,000 new workers in underserved communities be a more impactful investment than Huntington? We don’t ask this type of question enough.

To tackle huge problems, direct impact investors should embrace the scale created by mainstream capital markets and large traditional companies.

Strategies for Achieving Scalable Outcomes

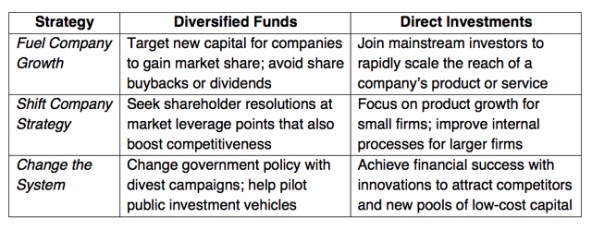

To cut through this complexity, we propose a simple rubric to guide investors who, like the 100% Network, want more of their assets to intentionally pursue measurable impact outcomes while meeting their financial goals:

1. Fuel Company Growth

Diversified funds can help good companies invest in innovation, marketing, or geographical expansion to take market share away from bad companies. This has a stronger causal impact on outcomes than negatively screening bad companies or funding share buybacks and dividends. In assessing ESG, perhaps a “U” for “use of capital” should be added to measure this effect. This strategy works best within inefficient markets where companies struggle to raise capital, such as low-volume debt and IPO markets.

For direct investments, companies need to access larger pools of capital to expand their impactful product or service. Companies that tap institutional mainstream or philanthropic capital—whether from foundations, development banks, or capital markets—can scale faster than those dependent solely on niche impact co-investors.

2. Shift Company Strategy

Funds can own both good and bad companies in their pursuit of shareholder advocacy to pressure CEOs and boards to change course to support impact goals. Nonprofits As You Sow and Ceres have guided hundreds of shareholder resolutions, mainly targeting environmental outcomes. Corporate activism generates bigger results when targeting companies that sit at a buyer, seller, or financing leverage point. For example, Sonen Capital recently co-filed resolutions at three major palm oil purchasers that resulted in improved sustainability. Diversification is the enemy, as it is hard to influence a company if impact investors only own a small fraction. New activist impact funds should be formed to take large positions in companies to influence behavior, similar to how activist hedge funds achieve shareholder-friendly policies.

Direct investors can influence companies strategically as board members. For startups with limited footprints, scaling products drives the biggest outcomes. For large companies, internal employment policies and purchasing behavior play a larger role. Investors should prioritize policies that align impact and profitable growth, creating a positive feedback loop to fuel growth.

3. System Change

Funds can set new market norms by “voting with their dollars” to support policy goals. Historically, Oxford’s Smith School found that divestment campaigns had limited direct impact on access to capital but fantastic success in helping pass new legislation to constrain targeted sectors. The recent Divest-Invest Fossil Free campaign is explicit about its domestic goal of making it “politically feasible for Congress and the Administration to take bolder action.” Beyond policy, funds can also derisk unproven public financing vehicles that others will quickly replicate if they attract capital, as recently occurred with NRG Energy’s clean energy YieldCo.

Direct investors can propel a whole sector to scale if they demonstrate financial success with a pioneering innovation or business model; doing so will attract waves of competitors and mainstream capital to fund growth. Similar philanthropic levers, such as loan guarantees and first-loss capital, can attract larger foundation or mainstream capital pools. This model has attracted institutional investors into sectors such as global microfinance, green bonds, charter school loans, distributed energy, and social impact bonds.

What’s Next?

Impact investing sounds simple—aligning pure motives, profits, and positive change. But the reality is that groups like the 100% Network must navigate conservative advisors, confusing definitions, and complicated metrics.

An often-ignored conundrum drives this complexity: Impact investors require diversification and liquidity to meet risk requirements, but diversification and liquidity limit the measurable outcomes that impact investors demand. We don’t need 200 years of debate to recognize that this constraint is inhibiting the trillions of dollars needed to tackle global problems at scale.

As more investors join the movement, a simple rubric that encompasses funds and direct investments can help focus assets on the biggest levers of scalable change: fueling company growth, shifting company strategy, and changing systems.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Adam Rein.