In part two of this series, we analyzed the implications of first-stage scaling on an enterprise’s operations, including its leadership and team, governance structure, and its interaction with the broader ecosystem. This third and last blog looks at ways to design the appropriate financing package for social enterprises preparing to scale.

Grants are an important element of the financing mix

We strongly believe that early-stage enterprises in the incubation phase of their activities need grants to develop their innovative ideas. We’re referring to grants of around $75,000 over three years to test the model and develop a proof of concept. Grants can cover the social costs that enterprises incur, such as beneficiary training to gain access to formal employment or sell in higher-value markets. Also, during incubation, other types of financial support such as bank loans or impact investments are generally not available, given the perceived risk of the enterprises operating at this stage; grants are generally the only means to fund a proof of concept. In some cases, social enterprises can access loans during incubation for specific uses, such as short-term working capital or secured loans (for example, to purchase property or equipment).

Grants are still relevant during first-stage scaling, but they have a different purpose—to prepare for ramping up. The case of Reciduca is a good example. As noted in the previous post, the enterprise runs an employment agency in Argentina that trains and places at-risk youth on the labor market. During first-stage scaling, Reciduca’s challenge is designing the appropriate strategy to increase its presence from 6 high schools to 35 in a period of 5 years, in a way that is cost effective and does not jeopardize the quality of the youth training. The training component requires that grant funding is sustained until Reciduca can replicate to enough schools and the employment agency fees can cover the training costs.

Grants can also be important in cases where organizations are replicating the model and there is heavy upfront investment in a new entity. In the case of Kek Madar, a social enterprise in Hungary that runs a restaurant employing people with disabilities, the strategy for scaling up its impact is franchising the successful integration of jobs training with high-quality cuisine. Various organizations in the country have expressed interest in a franchise model, and some have started replicating the restaurant. Launching a franchise will be quite costly, and it would be very difficult for the franchisee to take on a loan for all startup expenses. A model like this one usually takes at least three years to break even, and profit margins are low. In this case, securing a grant as startup capital would lower financial risks for the enterprise and funder.

The first patient investments

Are you enjoying this article? Read more like this, plus SSIR's full archive of content, when you subscribe.

First-stage scaling also offers the opportunity to provide the first non-grant investments to social enterprises. It is important to find the right funding mix between grants and investments: It’s not about philanthropy anymore, but it’s also not about market rates of return. The typical size of investments for financing first-stage scaling ranges from $75,000 to $300,000, which is several times larger than typically provided at incubation/proof of concept, but also much lower than what most impact investing funds can finance.

Managing a loan or equity investment, as opposed to a grant, requires a new set of skills for social enterprises. At first-stage scaling, the introduction of investments is important for the enterprise to build a track record and to prepare for additional rounds of financing in later phases of the scaling process. It is also a way for social enterprises to begin to understand the cost of capital and build those costs into the first-stage scaling plans. Meeting projections to comply with a repayment schedule is a healthy exercise for an enterprise. Having a more diverse capital structure may also allow the enterprise to attract new and larger forms of financing; some donors and investors view favorably an enterprise that has successfully raised donations and patient investments for its first-stage scaling. This is the case for Kek Madar, which received a $55,000 loan from NESsT to purchase its building, and this initial investment unlocked additional EU funding for refurbishing the restaurant.

Preparing social enterprises to take on their first investments requires time. Investment-readiness programs exist for social enterprises to acquaint them with different investment types, and help them understand the benefits and drawbacks of each. Often a pre-condition to attracting investments includes developing appropriate accounting and financial systems that give investors the assurances that the enterprise will properly allocate investments. In some cases, such as UPASOL, which we described in the previous post, social enterprises need to warm up to the concept of using investments to finance first-stage scaling. It may require modifying internal policies to allow non-grant financial instruments. In other cases, it entails working with the enterprise management and board to explain the benefits of taking an investment. This process of investment-readiness can take six months to a year.

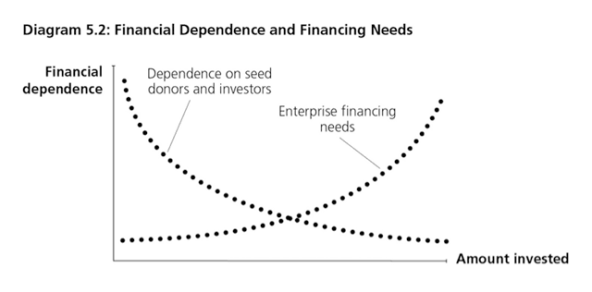

Financial dependence and financing needs. (Image from Loïc Comolli and Nicole Etchart, 2013, Social Enterprise in Emerging Market Countries: No Free Ride. New York, NY: Palgrave Macmillan)

Financial dependence and financing needs. (Image from Loïc Comolli and Nicole Etchart, 2013, Social Enterprise in Emerging Market Countries: No Free Ride. New York, NY: Palgrave Macmillan)

For donors and investors providing financial support to early stage social enterprises, first-stage scaling also has implications on the relative financial influence of these funders on the capital structure of the enterprise. As enterprises move into first-stage scaling, their financing needs increase, which leads to a search for new funding sources and funder-base diversification. This is a benefit, because as the enterprise works with a large pool of funders it becomes less dependent on any one source and the financial risk decreases.

Conclusions and recommendations

We hope that we have painted an objective picture of the process and best practices in moving early-stage social enterprises from incubation to first-stage scaling. The attribute that most often jumps out at us when working at the early-stage is “patience.” Moving an enterprise from proof of concept to scaling-readiness can take, in our experience, five to seven years. Organizations supporting early-stage enterprises should be close to the enterprise team throughout and set clear incubation goals that they can measure to track progress. Once those are met, the enterprise can move to first-stage scaling to prepare for significant growth.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Loïc Comolli & Nicole Etchart.