Increasing income and wealth inequality have received a lot of attention since the Great Recession. It’s shocking to see how the incomes of the top 1 percent or even the top 0.1 percent have risen in the last few decades. It’s perhaps even more shocking to learn that the top 1 percent of wealthy Americans own 35 percent of the total household wealth of the nation, while according to Pew’s Survey of American Family Finances, in 2015 41 percent of households didn’t have $2,000 in liquid savings.

These are historic and important inequities. But a third financial inequality threatens to make these inequities even worse yet has received far less attention: inequality in access to steady, predictable cash flows. When we think of income, we think in terms of annual totals. When we think about wealth, we think about year-end account balances. Yet what keeps many people up at night are the ups and downs of their finances within the year—and whether or not they will have cash on hand to pay next week’s bills. While we all know that income and expenses can fluctuate from month to month, we tend to assume that the variability is negligible or at least predictable—a five-week month or a tax refund or the holidays, for instance.

Income Volatility

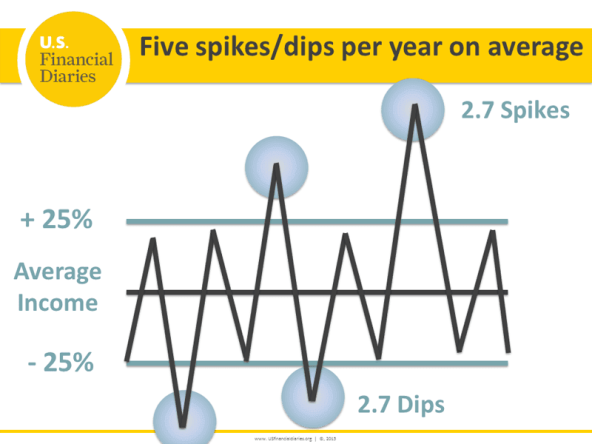

The data we gathered during the US Financial Diaries project indicates how wrong this often unspoken and unnoticed assumption is. On average, the families we followed for a year had more than five months when income was either 25 percent above or below average. And that excludes tax refunds, which dramatically increase income volatility.

Income volatility, we found, has many sources. The households we got to know usually had multiple people working, and many workers had more than one job. Those jobs were unsteady, coming and going within the year. But even the jobs that were relatively steady— meaning a person held the job for all 12 months—had fluctuating hours. And because so many of the jobs were hourly, missing work for an illness, a family emergency, or a car breakdown meant lower wages.

On average, households participating in the US Financial Diaries study had more than 5 months a year when income was more than 25 percent above or below average, even after excluding tax refunds. (Image courtesy of US Financial Diaries, 2015)

On average, households participating in the US Financial Diaries study had more than 5 months a year when income was more than 25 percent above or below average, even after excluding tax refunds. (Image courtesy of US Financial Diaries, 2015)

Spikes and dips are not just a problem of the poor. Even middle-income households in the study faced substantial income fluctuations.

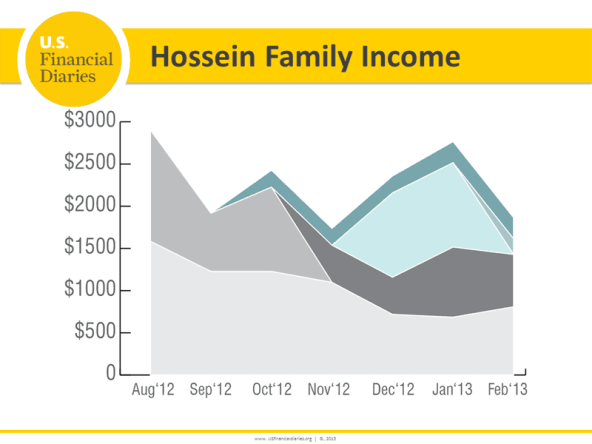

What does income volatility look like for a household? Consider the Hossains (families’ names are changed to protect their privacy), an immigrant family in New York.

Over just nine months, they saw their income move from nearly $3,000 to $1,700 and back again (and then down again). Why? Because they were trading up on their employment. During the course of the project, two household members changed jobs multiple times, seeking higher incomes and steadier wages, often forgoing income to get training.

The Hossains traded up to higher-paying jobs several times during the study. But that meant a lot of volatility in their income from month-to-month. (Image: "The Hossains: Adapting to a New Life in the US," US Financial Diaries, 2015)

The Hossains traded up to higher-paying jobs several times during the study. But that meant a lot of volatility in their income from month-to-month. (Image: "The Hossains: Adapting to a New Life in the US," US Financial Diaries, 2015)

Or consider the Garzas, who live south of San Francisco.

Income from the their main breadwinner’s primary job is fairly steady but not enough to make ends meet, so he also takes on side jobs while his wife makes and sells jewelry to friends and neighbors. Their average income of $2,800 a month covers their average expenses of $2,500, but they turn to costly loans and pawn shops to bridge from lower months to higher ones.

Expense Volatility

It is not just incomes that are volatile. Expenses are volatile too. Again, there’s a commonly held belief about how unforeseen expenses derail family budgets. You have certainly heard a narrative that goes something like, “They were getting by, but then one thing went wrong ... ” But the “one thing went wrong” story is not what showed up when we looked at household expenses. We saw frequent spending “spikes”—months when expenses where significantly higher than average—but when we looked to see what was causing those spikes, it was very rarely just one thing.

The Garzas, a family in California, stitched together income from several sources, none of which were fully reliable. (Image: "Spikes and Dips: How Income Uncertainty Affects Households," US Financial Diaries, 2015)

The Garzas, a family in California, stitched together income from several sources, none of which were fully reliable. (Image: "Spikes and Dips: How Income Uncertainty Affects Households," US Financial Diaries, 2015)

In 65 percent of cases, increased spending in more than two categories of expenses (such as food, transportation, health care, and clothes) caused a spike. In more than half of spikes, spending was well above average in more than three categories. In other words, “emergencies” come in many forms, and often together.

Mismatch

Of course, those emergencies didn’t conveniently align themselves to times during the year when families earned more than average. Of the total spending spikes, 61 percent occurred when there was no income spike, and 25 percent occurred when income was below average. There’s a significant mismatch between the typical households volatile income and volatile expenses.

Mismatches like these are what financial services are designed to solve—to move money from when we have it but don’t need it to the times when we need it but don’t have it. That’s a big part of what savings, credit, and insurance do. In large part, the families we followed coped with this mismatch via savings. When households had a spending spike, they typically financed half of it by drawing down savings. When that wasn’t enough, they turned to friends and family for help, just as often as they used credit cards.

Short-Term Savings

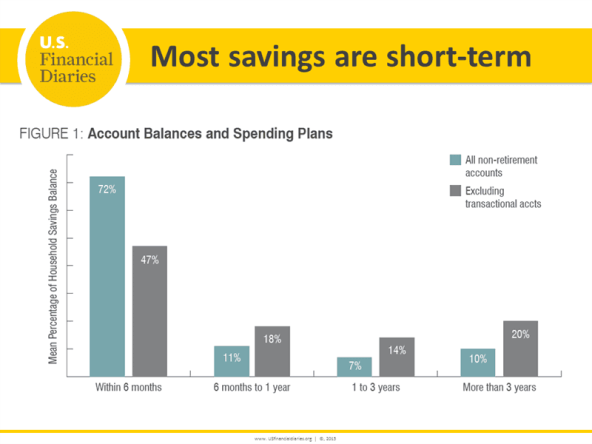

Based on statistics about American households’ dismal savings rates and how few families have emergency savings sufficient to meet the general guidance of financial advisors, many think lower- and middle-income households are not saving at all. That’s not what we saw. We saw families saving a lot—but not in ways that would show up in typical surveys about “savings.” Most surveys look at balances at one particular point in the year, or compare an end-of-year balance to total annual income.

But with mismatch between income and expenses, we saw lots of short-term saving. Families weren’t spending everything they earned as they earned it, but they also weren’t able to set aside money for more than a few months. So when a spending spike came along without a matching income spike, they were forced to spend down their savings.

USFD participants expected to spend the majority of funds they thought of as savings within a year, even savings held outside of transactional accounts. (Image: "Savings Horizons", US Financial Diaries, 2016)

USFD participants expected to spend the majority of funds they thought of as savings within a year, even savings held outside of transactional accounts. (Image: "Savings Horizons", US Financial Diaries, 2016)

We asked households when they thought they would spend the money they had saved. On average, they expected to spend 83 percent of their savings (regardless of whether they were “checking” or “savings” accounts, or even whether they were at a formal financial institution) within the year.

Implications

Unfortunately, current thinking about the challenges lower- and middle-income households face and how to help them isn’t well-aligned with the prevalence and size of income and expense swings we saw. The implications of income and expense volatility are large and varied, and beg questions such as: “How do we assess ability to re-pay a loan?” “How can people build long-term savings when income is so volatile?” “How should we assess eligibility for services and benefits?” We have to rethink issues as basic as financial rules of thumb. For example, what financial management advice is appropriate for a household that is carrying high-cost debt, is trying to help a child through college, and has no emergency savings? Behavioral nudges to get people to think about the long-term aren’t enough. We need new products, programs, and policies designed to address income and expense volatility, and that build on the short-term saving that households are already doing.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Jonathan Morduch & Rachel Schneider.