SPONSORED SUPPLEMENT TO SSIR

SPONSORED SUPPLEMENT TO SSIR

Innovating for More Affordable Health Care

This special supplement includes eight articles that explore new ways for social investors to spur innovations that create better, faster, and less expensive health care in the United States. The supplement was sponsored by the California HealthCare Foundation.

In 2010, BeWell Mobile faced a dilemma all too common among startups in the health care field: how to fund the growth of breakthrough innovations that both lower costs and improve the standard of care when the patients and providers who often benefit the most have the least ability to pay.

The San Francisco company develops customized disease management software that operates on devices like cell phones. In an eight-month pilot study with the San Mateo Medical Center, funded by the California HealthCare Foundation, 50 bilingual, uninsured teens with severe asthma recorded their symptoms by phone at least once a day using BeWell’s technology. The real-time feedback, reminders, and other interventions they received in response caused the patients’ drug compliance to more than double, their need for rescue medications to be cut in half, and their visits to the emergency room and their days of missed school to fall dramatically.1

In most fields, results like these would have had investors beating down the doors. But despite the promise of its technology, BeWell hasn’t been able to demonstrate a business model that resonates with venture capitalists. In the current health care system, clinicians aren’t reimbursed when poor patients on Medicaid avoid going to the hospital—only when they receive care. In effect, Medicaid accrued the benefits of keeping the pilot program’s patients healthier and reducing the overall cost of their care, while the physicians at San Mateo Medical Center who did the work received little financial reward. In this scenario, it’s no wonder that the hospital decided it couldn’t justify a longer-term investment in BeWell’s technology.

BeWell’s story illustrates the challenges facing companies that try to enter underserved markets, defined as low-income people and the health care providers who serve them. In particular, this segment of the health care field has a significant need for new medical technologies that expand access to important diagnostics, treatments, and specialty services while reducing costs—all without sacrificing the quality of care. Think of remote monitoring technologies that check on the vital signs of the elderly, people with chronic health conditions, or those recovering from a serious illness so as to enable providers to intervene before a crisis occurs.

Many of these technologies have the potential to help underserved populations that receive care from so-called safety net providers. Such providers serve disproportionate numbers of the uninsured and those on Medicaid by offering free or discounted care. They include public hospitals, community health centers and clinics, and for-profit and nonprofit health care organizations.2 Because of their mission and the socioeconomic status of the majority of patients they serve, safety net providers face severe resource constraints.

The problem is that traditional funders of health care innovations, such as venture capitalists and corporate investors, are seeking significant rewards to compensate for any risk they take. “Investors are looking for unbounded upside with the least amount of risk possible,” said Josh Makower, founder and CEO of device incubator ExploraMed. But, he explains, “Most investors don’t expect to find big, unbounded opportunities in low-resource environments.”

Medical technologies with high social value—those with the potential to reduce costs, improve outcomes, and increase access for underserved populations—can play an important role in helping safety net providers use their resources more efficiently to better serve millions of patients. But these products and services may not necessarily generate the high financial returns that investors expect, particularly when the benefits are misaligned, as in the BeWell example. For this reason, many companies have struggled to secure capital to fund the development and commercialization of important innovations.

This misalignment between the risks and rewards associated with innovative new technologies must be overcome if the United States is to improve its health care system significantly over the coming decade.

HOW TECHNOLOGIES GET FUNDED

Medtech innovators typically have two choices when seeking the cash they need to achieve scale: venture capital and corporate investment. Venture capital is by far the largest source of funding in the medtech field. In 2010, for instance, US venture capitalists invested $2.3 billion in 324 medical device startups, according to PricewaterhouseCoopers.

Venture capital, also referred to as venture financing, typically helps startups establish or sustain a business with high growth potential. A venture capitalist (VC) makes an investment, and in exchange, the VC’s firm receives equity in the company. The expectation is that the investors will be able to realize a substantial return on their money through an “exit event,” such as selling the company to another firm, at some point in the future. This type of funding is especially helpful to startup companies that do not yet have an operating history, revenue, or significant collateral, and therefore lack access to other sources of capital, such as bank loans.

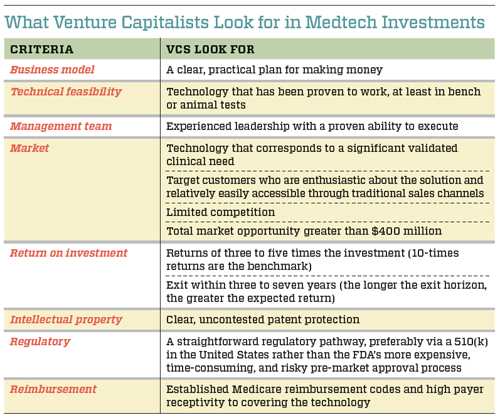

In the medical devices sector, VCs select their investment opportunities using specific criteria that help them balance the risk-reward equation. Although every VC takes a slightly different approach to evaluating new technologies, there are some common criteria that they all use, such as the strength of the management team, the technical feasibility of the product, and the size of the potential market. (See “What Venture Capitalists Look for in Medtech Investments” below.)

In combination, these criteria assist VCs in placing their bets. The more risk they see as they evaluate the opportunity, the greater the market size and potential return on investment must be to get them interested. Because a large portion of venture capital deals fail to earn any return on investment, those that succeed must compensate for the losses. “If roughly 20 percent to 40 percent of companies succeed, you need these companies to make up for the capital invested across the portfolio and generate a return for investors,” says Mudit Jain, a partner with venture capital firm Synergy Life Science Partners. Returns for VC-funded companies considered to have achieved a successful exit range from 300 percent to 1,000 percent, or three times to 10 times the total investment.

Another common funding source for medtech innovators is corporate investment. Large corporations, such as Johnson & Johnson and Medtronic, can help fund startups by underwriting a specific research and development effort through a development partnership or by investing in the company as a traditional VC would. Corporations have criteria similar to those that VCs use when evaluating opportunities. Unlike venture investors, however, corporate investors are looking for investments that will also create synergies with other products in their portfolios or new opportunities aligned with their growth strategy. If a new technology is strategically attractive, a company may be slightly more flexible than VCs when making an investment.

THE TWO SIDES OF THE SAFETY NET MARKET

Unfortunately for innovators who want to develop technologies that aid underserved populations, VCs and corporate investors use the same demanding criteria to evaluate these technologies as they use to assess mainstream commercial opportunities. What’s more, VCs today face even greater pressure to produce results, and they may have less money to invest than in the past. In combination, these factors can make it difficult to get funding for technologies that could benefit the safety net but pose greater investment risk.

“The investors we represent don’t look to us to do their humanitarian work,” says Michael Goldberg, a partner with venture capital firm Mohr Davidow Ventures. “They look to our firm to generate a return on their investments in a way that’s hopefully compatible with their humanitarian values. If we told them we were going to sacrifice investment returns in any material way in an effort to better serve the general welfare of the US or world population, I think they would move their money as soon as they had the opportunity.”

When asked what advice he would give to innovators seeking funding to meet clinical needs in low-resource settings, William Starling, managing director of Synergy Life Science Partners, says bluntly: “Avoid venture capitalists. Venture capitalists are trying to survive. There’s just no way they’re going to put money into efforts that don’t meet the minimum bar for return on investment in the current climate.”

Despite the perception that low-resource environments can’t generate big returns, the safety net shows some promise as a market opportunity for commercial investors—specifically, it can be used as a launchpad for cost-reducing technologies. As the entire health care system becomes more cost constrained, technologies that can reduce spending should become more broadly appealing. Proving the value associated with these products under the challenging conditions of the safety net could potentially help them cross over into mainstream commercial settings. In the process, it would help establish the safety net as a preliminary market from which companies could expand.

Innovators can also consider expanding from the safety net into low-resource environments abroad. “If you can actually find a solution that makes sense in [US-based] resource-constrained environments, you may be able to enter the true growth markets of tomorrow,” says Ed Manicka, CEO of medical device maker Corventis. “Specifically, India and China are demanding low-cost solutions that are technologically on par with what is available in the United States. Now, clearly, the margins are going to be lower, but the pure scale is mind-boggling.”

Finally, the size of the underserved population, although small compared with the total US market, is still substantial. Medicaid covers roughly 48 million low-income families and another 14 million elderly and people with disabilities. Total Medicaid spending for fiscal 2010 was approximately $365 billion, almost a 9 percent increase over the previous year, and the budget is expected to continue growing for the foreseeable future. Although there are significant challenges associated with reaching and serving these patients and their providers, the population represents a sizable opportunity for innovators who can figure out how to serve it profitably with high-value, lower-cost solutions.

THE CASE OF REMOTE MONITORING

A specific class of products known as remote-monitoring and intervention technologies illustrates the challenges and opportunities that innovators face when they seek venture funding for innovations that have high social value. Although remote monitoring can potentially reduce costs, improve care, and increase underserved patients’ access to specialty care, venture investment in this area has been slow and somewhat inconsistent.

Devices like blood pressure cuffs and glucose monitors enable physicians and other care providers to check and treat patients’ conditions without being physically present. Costs can be lowered when care shifts to a less expensive setting, such as a clinic or a patient’s home. By keeping people out of the hospital, these solutions can also significantly help improve people’s quality of life.

When VCs and corporate investors evaluate remote-monitoring technologies using their standard investment criteria, many innovations receive high marks for technical feasibility. “Remote-monitoring technologies are relatively low-tech in some ways—I mean, it’s not like we’re putting devices inside the body that are going to shock a patient’s heart,” says Suneel Ratan, a marketing, reimbursement, and government relations executive at Robert Bosch Healthcare, a leading corporation in the telehealth field. Most of these products are based on fundamental technologies that have proved themselves in sensors, data communications, or other fields.

Moreover, because the devices are for external use, they pose few safety risks for patients. As a result, they often receive regulatory clearance through the FDA ’s faster 510(k) review process. Most investors favor 510(k) products over those that require pre-market approval, and thus they may be more attracted to remote-monitoring innovations.

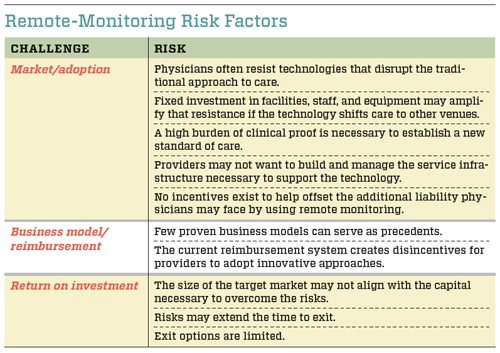

Although the technical and regulatory risks are relatively low, several other investment criteria have proved to be problematic for many remote-monitoring solutions. Investors frequently decide not to fund the technologies because of a combination of market and adoption risks, as well as issues regarding business models and reimbursement. Investors are also hesitant to commit resources because they perceive a low potential return on investment. Each is a significant barrier that must be overcome in order for new technologies to move forward. (See “Remote-Monitoring Risk Factors” below.)

The story of Health Hero Network illustrates each of these barriers to funding, as well as the challenges traditional investment criteria create. At the time Health Hero Network was established in 1998, the Palo Alto, Calif.-based company’s primary product was the Health Buddy System for monitoring and improving the health of high-risk, high-cost elderly and disabled patients with one or more chronic conditions.

Patients used a simple, four-button device that each day led them through interactive sessions of six to 10 questions customized for the person’s condition. Primary care physicians and specialists prescribed Health Buddy to teach patients how to understand their conditions better, help them change their behavior, enable the early detection of health risks before they escalated to an acute stage, and provide reassurance to patients that their health was being monitored. Health Hero Network supplied the technology and training for users; the health care provider set up the basic infrastructure for receiving, interpreting, and acting upon data transmitted from patients’ homes.

After Health Hero Network developed the technology, it conducted a series of demonstration studies to prove the system’s value. A small early study with the health plan PacifiCare showed a 50 percent reduction in hospital readmissions for heart failure patients who used Health Buddy, according to Ratan. Despite these encouraging results, PacifiCare eventually decided to outsource its disease management services rather than adopt the technology.

In 2000, Health Hero Network launched a pilot with the Veterans Administration (VA) in Florida. The study of 900 patients using Health Buddy found a 63 percent reduction in hospital readmissions and an 88 percent decline in nursing home days.3 Approximately four years later, Health Hero received its first national contract with the VA. The agency agreed to directly fund the purchase and use of Health Buddy technology and related services.

Health Hero Network then approached the Centers for Medicare & Medicaid Services (CMS) about securing reimbursement for its product. “The largest and most expensive group of patients you can go after globally is the folks on Medicare,” Ratan says. “[Health Hero Network] had a desire to prove that health care management interventions with the Health Buddy would generate a similar result in a fee-for-service system.” The company submitted a proposal to CMS and got approval to launch a three-year demonstration study in 2006. The results have not been officially released, although Ratan described them as “jawdropping.” CMS extended the demonstration project in 2009, but as of this writing has not yet decided whether to grant reimbursement for the product.

Robert Bosch Healthcare acquired Health Hero Network in late 2007, when more than 20,000 people with chronic conditions were using Health Buddy. After receiving about $72 million in total known funding, the company was sold for $116 million, a return of roughly 1.6 times the investment.

In deciding to sell the company, Health Hero’s board presumably determined that an exit at that point was financially more attractive for its investors than the alternative of raising more capital in order to drive reimbursement changes and increase market adoption. The funding environment in 2007, along with the company’s progress to date, most likely made it difficult for Health Hero’s investors to envision a compelling return on investment from putting in more money and extending the investment time horizon.

Other risk factors also played a role in preventing Health Hero from raising additional capital to commercialize the Health Buddy product on its own. The high burden of proof required to change physician behavior and drive widespread market adoption turned out to be time-consuming and costly to the company, causing it to burn through the funds it had already raised. Adoption was also limited primarily to integrated health care providers like the VA, which could benefit from the longer-term, system-level savings associated with such improvements as reduced hospital admissions. Fee-for-service providers remained unconvinced of its value, especially without reimbursement for activities or technologies that keep people out of the hospital. That reduced the size of the market in the near term. As Ratan explains: “The premise of the Health Buddy system is chronic care. It’s continuous, supportive, and designed to build an individual’s capability to take better care of himself. But the health care system is engineered for acute care—the incentives are structured largely to wait until someone’s in crisis.”

STRATEGIES TO ADVANCE THE FIELD

New technologies, such as the Health Buddy and dozens of others like it, have the potential to reduce costs, improve health outcomes, and increase access to the services patients most need. But the social benefits these innovations create are undervalued in the way traditional VC and corporate investors make funding decisions. Foundations, social venture funds, individual philanthropists, and other socially minded investors can play an important role in correcting this market failure by altering investor perceptions of the risk-reward equation associated with these technologies. They can do this in three primary ways.

Fund Meaningful Pilot Studies to Reduce Safety Net-Specific Risks. After identifying the most promising technologies with high social value, social investors can help them succeed by underwriting and facilitating compelling pilot studies and clinical trials. This would directly reduce one of the most daunting costs of bringing promising innovations to market and could significantly reduce the time it takes to develop the clinical proof needed to catalyze provider adoption.

Such studies can also be designed to improve the attractiveness of the safety net as a market. There’s a common perception that safety net patients are less likely than other populations to comply with their prescribed treatments—including the use of technology. Rigorous studies with results that stand up to peer review may be able to demonstrate that underserved populations are no less compliant than other market segments. If particular patient groups continue to show difficulties with compliance, social investors might support the piloting of innovations to minimize these issues—for example, by shifting the burden of treatment or testing from the patient to the provider or by making patient requirements more fail-safe.

To get good value from the studies they fund, social investors must think more strategically than they have in the past about what to test, how to test it, and what data should be generated. The majority of pilot studies should include controls, produce publishable results, and include a rigorous economic evaluation of the technology, so that decision makers who can influence adoption perceive the data as credible.

To accomplish these objectives, social investors can collaborate directly with payers to determine the kind of value proposition data—cost savings, improved care metrics, and so on—they would want to see before they would be willing to pay. Then they could design and fund a pilot to gather those data. In the BeWell example at the beginning of this article, the company might have generated greater interest from investors and health care providers if its pilot study had been specifically designed with the goal of demonstrating significant value for customers and determining the return on investment required for adoption. That, in turn, might have eliminated some of the risks for traditional venture investors and health care organizations. Translational work of this kind would help innovations get uptake in the market and attract investment.

Change Policy. In parallel, social investors can help address business model and reimbursement-related risks, such as the ones Health Hero Network faced, by urging CMS and federal lawmakers to realign incentives in the current reimbursement system to support the use of technologies that reduce costs, improve care, and increase access, even if this means shifting the venue or disrupting the traditional model of care.

Existing incentives for “closed” health care providers, such as the VA, Kaiser Permanente, and other managed care organizations receiving fixed payments for services, may be adequate as long as sizable, long-term capital investments are not necessary. But direct reimbursement for innovative new technologies would certainly strengthen their motivation. It would also make the technologies more appealing to providers that still serve fee-for-service Medicaid and Medicare patients.

In 2011, a unique opportunity exists for social investors to interact with the new Center for Medicare and Medicaid Innovation, which Congress created under the Affordable Care Act. This division of CMS has a mandate to test innovative payment and service delivery models to reduce program expenditures while preserving or enhancing the quality of care for Medicare and Medicaid recipients. It has been given $10 billion in funding to explore new payment models between 2011 and 2019, which means that social investors are perhaps better positioned than ever before to collaborate with the center and influence its policy recommendations.

Another aspect of the Affordable Care Act that may present opportunities for social investors to effect change is the introduction of accountable care organizations (ACOs). ACOs are virtual networks of doctors and hospitals that share responsibility for providing care to a defined population of patients over a specific period of time. The ACO concept is intended to make groups of previously disconnected providers jointly accountable for the health of their patients, giving them stronger incentives to cooperate and save money—for example, by avoiding unnecessary tests and procedures. With these new incentives, technologies that keep patients out of the hospital may become appealing to traditional fee-for-service providers that previously wouldn’t have considered them.

The details of the ACO model still remain to be proven, but social investors can lend valuable insights as policymakers and providers figure out how to make the approach work. For instance, investors who are considering ACOs as potential buyers of medical technologies may be concerned that they will face long sales cycles that require approvals by the network’s board of directors before new products can be adopted. Social investors can potentially anticipate such risks and, through the pilot studies they support, gather data aimed at shortening sales cycles for ACOs.

Establish Dual-Market Potential. Because subsidized business models are rarely sustainable over the long run, social investors have a vested interest in increasing the crossover potential of cost-saving technologies that have been shown to serve safety net populations effectively. Reimbursement reform and the advent of ACOs will potentially increase the opportunity for technologies optimized for the safety net to penetrate commercial markets in the United States. Specifically, reimbursement reform will create incentives to encourage the adoption of new technologies among Medicare fee-for-service providers beyond the safety net (with private payers following Medicare’s lead in granting reimbursement). Similarly, ACOs will involve not just Medicare and Medicaid beneficiaries, but patients with private insurance as well, thereby giving private payers another reason to think differently about preventive care. By supporting these policy changes, social investors will help establish dual US markets for safety net innovations.

Social investors can further support technology crossovers by coordinating networks of VCs with an interest in investing in overseas markets and introducing them to technologies that reduce costs while improving health outcomes. Outside the United States, large emerging markets in countries like India and China are attracting significant attention. Some of the technologies that have been shown to deliver value to safety net providers may be strong candidates for improving health care in the developing world for tens or hundreds of millions of customers.

FUNDING SOCIAL INNOVATIONS

When it comes to funding innovations with high social value, social investors can use several models. Targeted grantmaking is perhaps the most common form of support that foundations, philanthropists, and government agencies offer. Innovators receive financial support from these entities with no expectation that they will repay the money. With effective targeted grantmaking programs, such as the US Small Business Innovation Research (SBIR ) program, funding is awarded for a specific purpose (for example, conducting a defined pilot study) and must be linked to a specific commercialization plan for moving the technology to market.

Program-related investment is another common form of funding. It has been around since 1969, but it has become increasingly popular over the last 10 years. Recognizing some of the inherent limitations of grantmaking, such as the dependence these subsidies can create, social investors like the Acumen Fund developed processes for providing “social capital” to bridge the gap between the efficiency and scale of commercial venture capital and the social impact of pure philanthropy.4 With these models, capital is raised from donors (typically large foundations) and then invested in fledgling companies with products and services that have the potential to generate high social impact, achieve scale rapidly, and become self-sustaining within five to seven years.

The companies benefiting from program-related investments might be given loans, guarantees that allow them to access capital through other channels, or investments in exchange for equity. The social investor expects to earn a return on its money, but the rates, investment horizon, and other terms are less stringent than traditional venture requirements. Acumen Fund, for example, expects that approximately half of its investments will succeed and half will fail. For this reason, it hopes to realize a two-times return on its successful investments, so that 100 percent of all capital raised from Acumen donors can be reinvested multiple times.5 Other entities recycling donor capital in this way within the health care field include the Bill & Melinda Gates Foundation, the Robert Wood Johnson Foundation, and the California HealthCare Foundation with its Innovations for the Underserved fund. (For more information about this strategy, see the “Foundations as Investors” article.)

Social venture funds are yet another source of capital. With this type of financing, no donors are involved; foundations, corporations, and high-net-worth individuals make debt or equity investments into a fund and become limited partners, as they would with any private equity or venture fund. The fund pursues a social mission, however, in addition to seeking to generate a financial return for its investors. “Investors take an outsized risk for the ability to have a social impact,” explains Raj Kundra, director of capital markets at Acumen Fund. The Acumen Capital Market fund has attracted investments from such high-profile foundations as Rockefeller and Skoll. By offering returns, even though they might be below market rates, fund managers are able to raise and deploy significantly larger amounts of capital than they could by raising donations for grants or program-related investments.

Foundations, in turn, contribute to these funds to help technologies with high social value reach a point at which they are attractive to traditional investors. As Kundra says, the goal of impact investing is to provide a proof of concept for interesting technologies and then bring in new sources of capital once these innovations are far enough along to meet more traditional investment criteria.

A fourth funding option focuses on commercializing innovations developed in academic settings. From 2006 to 2011 the Wallace H. Coulter Foundation awarded grants of $5 million to nine universities. The schools used the money to provide seed funding to projects that had the potential to generate treatments and devices that improve human health. At Stanford University, one of the grant recipients, 25 such projects were funded during the five-year period. A panel of academics, entrepreneurs, and investors selected the projects, and each one followed a rigorous development process that included a detailed commercialization analysis. Almost half of these projects moved toward the marketplace as a result of the funding, and they have secured $43 million in follow-on funding, with 49 percent from nongovernment sources.

Following on the success of the program, the Coulter Foundation established a $20 million endowment at Stanford to support funding of such translational projects in perpetuity. By staging its investment, the foundation proved that a rigorous development process can work in an academic setting to increase the rate at which new technologies reach the market. It also demonstrated how such an approach can accelerate the translation of early-stage discoveries into marketable products. Other foundations with an interest in supporting the development and commercialization of products or services that can reduce the cost of health care in environments with limited resources—without sacrificing quality—could potentially pursue similar funding models.

CONCLUSION

Nearly all health care stakeholders now believe that the future of the entire system depends on gaining better control of rising costs. As a result, interest is growing in innovations that enable more efficient and cost-effective care. Traditional investors appear more open to funding such projects, as long as they can generate sufficient financial returns.

Social investors can play an important role in this movement. They can identify opportunities to reduce risks, change policy, and help establish dual markets for bold, potentially market-transforming ideas that otherwise could struggle to raise funding from traditional sources. They can also provide flexible, long-term capital in the form of targeted grants, program-related investments, social venture funds, or endowments. Through these mechanisms, donors, investors, funders, providers, and innovators can help ensure that high-impact innovations find their way to the patients who need them the most.

See the complete healthcare supplement.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by Stefanos Zenios & Lyn Denend.